One spring afternoon in 2008, Mary told me of a case where a family conflict was exacerbated by lent money. Her eldest daughter, Sandra, and her husband, Daniel, needed 3,500 pesos to move to a new house in Villa Olimpia. Sandra asked her uncle Jorge to lend them the money. The couple agreed with Sandra’s uncle to wait until they had saved up the full amount of the debt before repaying him. However, the repayment occurred much more quickly than originally decided—and was distressing.

Two weeks after Sandra’s uncle had lent them the money, the family got together to celebrate the birthday of one of Mary’s other daughters. The dinner ended at around midnight. Mary was cleaning up the kitchen when she heard the voices start to rise out on the patio, where the others were playing cards.

The card game had been interrupted.

“Quit cheating.”

“Who’re you calling a cheater? You’re the cheater and you always have been.”

Jorge was the one shouting and slurring his words. It was clear he had had too much to drink. The more the others tried to calm him down, the more he insults he spewed. A few seconds later, he took the deck of cards and tossed it in Sandra’s face.

Keeping in mind Jorge’s generosity a few weeks earlier, Sandra’s husband had not wanted to get involved. But he couldn’t hold back when he saw his wife being mistreated.

“Come out onto the street and fight like a man, instead of going after a woman.”

“What’s your problem?” Jorge responded. “Everyone here knows you can’t even pay your bills.”

Daniel’s expression changed; he turned on his heel and left. Sandra saw the look in his eye and knew he was heading home for his gun. She rushed after him, followed by her siblings. While they reached the couple’s new home, Uncle Jorge came staggering behind them shouting, “I want my money. You’re never going to pay me back, because you’re a deadbeat.”

Mary remembered that dramatic night all too well. The quarrel went on for hours. Jorge kept saying that they would never return the loan; he humiliated them outside their home, for all their relatives and neighbors to see and hear, before finally heading off to bed. The whole affair ended early the next morning, when several of Sandra’s siblings and Daniel managed to come up with the full amount of the loan.

With the money in hand, they went to the uncle’s house. They counted out the bills and handed them over. They hadn’t spoken since.

Jorge had toyed with the uncertainty implicit in the return of any loan and inflicted humiliation by publicly expressing his doubt. “Everyone here knows you can’t even pay your bills,” he had announced in front of the whole family. Not returning the loan at that point would have been unbearable for Sandra’s husband. He weighed two different options—settling the score violently or taking out another loan—and opted for the second.

Violence as an alternative response to being accused of financial unreliability reveals the emotional and economic weight of this public affront. In an economy of credit and debt based on interpersonal relations, the stigma of not repaying a debt is so strong that resorting to use of a weapon comes to seem a way to avoid potential economic and moral exclusion.

This is not a new argument. Different scholars in historiography (Fontaine 2008), sociology (Caplovitz 1967), and anthropology (Lomnitz 1975) have analyzed the moral dimension of loans and debt among the poor. However, the financialization of everyday life (Langley 2008) adds new questions to this hypothesis. One of the features of this process has been an expanded offering of consumer credit (Guseva 2008). In Argentina and in other parts of the world, the capitalist credit market now plays a key role in the economic lives of the poor (McFall 2014; Deville 2015; James 2015).

As a result of this process, there has been a return to one-sided narratives of credit and debt. In the past, classic works in anthropology and sociology have essentialized both formal capitalist loans and their alternatives, be they community-based (Geertz 1962) or informal loans (Caplovitz 1967). These narratives proposed a simplistic equation in which morality is treated as the flip side to capitalist credit.

There are two different yet complementary explanations for the recent return to these one-sided narratives. The first is the widespread use of new technologies for evaluating creditworthiness. Such technologies tend to evaluate one’s capacity for repayment in terms of objective, measurable data, leaving moral or subjective elements out of the equation (Marron 2007; Carruthers and Ariovich 2010). As the Greek economist Costas Lapavitsas has noted, “The capitalist credit system is a set of institutional mechanisms focused on a formal mechanism of measuring trust. Since trust is objective and social, the moral force in capitalist credit is weak” (Lapavitsas 2007, 418). On the other hand, many defend “alternative financial” forms such as microlending (Maurer 2012), arguing that they add a new ethical dimension to the economy (Schuster 2015). My approach questions these narratives, since I do not consider morality as separate from capitalist credit or alternative finance.

The success of credit relationships depends on reducing uncertainty and anticipating the risks of not getting repaid (Knight 1921). Credit systems vary according to the way in which guarantees and credit scoring technologies are combined. Martha Poon (2009) has described the evolution of credit in the United States and the growing role of scoring technologies. In her work on French banks, Jeanne Lazarus (2011) analyzes how loan approvals combine moral assessments with objective indicators like job stability, place of residence, and so forth.

The notion of moral capital shows how uncertainty is reduced through a moral assessment of the borrowers. To contribute to current discussions about the moral dimension of credit and debt in everyday life (Peebles 2010; Graeber 2011; Gregory 2012), I propose considering the concept of moral capital in this book as a kind of guarantee, together with other kinds of capital, such as economic or legal capital, analyzing how the different guarantees interact, and how moral capital influences the process. This perspective sheds light on the “classification situations” (Fourcade and Healy 2013) within credit systems that influence the chances of people and groups.

From this perspective, moral capital is produced and in turn produces power relations when it serves as at least a partial guarantee of lent money. The financialization of the economy shapes the economic life of the poor, creating chances for distinction and moral domination. The poor must ensure that their virtues are conspicuous in order to access credit. By examining how consumer credit began expanding to low-income sectors in Argentina in 2003, this chapter unveils the moral hierarchies rooted in the circulation of lent money.

Financing Dreams of Consumption

While Mary anxiously waited to buy a new fridge with her friend’s credit card, her children were buying new clothes and tennis shoes with charge cards from local department stores. Some of her neighbors were making payments on personal loans from one of the many lending agencies that had been popping up near Villa Olimpia in the past few years. Many residents had bought furniture or home appliance on installments, with payback terms that took into account their variable incomes. Everyone in this low-income neighborhood was taking advantage of the new opportunities to make retail purchases and take out loans.

After the crisis in 2001 nearly brought banking activity to a standstill in Argentina, new trends transformed the field of credit.1 First of all, financing for retail purchases increased between 2003 and 2012. In absolute terms, consumer loans in pesos rose from AR$4.54 million in January 2003 to AR$106.3 million in April 2012, an astronomical rise in nine years, even considering inflation. In January 2003, consumer loans in pesos represented just 15.5 percent of the lending market, while 40.5 percent corresponded to retail loans and 44 percent to mortgages. In April 2012, consumer loans had risen to 41.2 percent of all lending in pesos, while 40.8 percent corresponded to bank loans and 18 percent to property loans.2

The credit market expanded as part of its diversification and segmentation. New loan strategies were unveiled, with a wide variety of bank loans and credit and charge cards;3 loans from lending agencies; loans from major supermarkets and clothing and home appliance stores; and loans from mutual funds and credit unions. Each lending instrument had its own particular prerequisites. To qualify for a bank loan or credit card, applicants needed a higher income and more years of employment. Non-bank loans were easier to come by, but payback terms were shorter and interest rates were higher; when it came to plastic, the interest rate on charge cards—easier to obtain than a Visa or MasterCard—was 35 percent higher than that of credit cards (D’Onofrio 2008).

The diversification and segmentation of the credit market allowed new social sectors to access formal credit. While this benefited the middle class, who recovered the purchasing power they had lost during the 1990s and then again during the 2001 crisis, the lower classes have also seized on the expanded access to credit to become borrowers.

In December 2009, I organized a survey on lending practices in the retail shopping area known as CyC (short for Crovara and Cristianía, two intersecting avenues), a shopping area just four kilometers from the San Justo shopping mall, in La Matanza, a district in greater Buenos Aires west of the capital. Whereas the San Justo mall sold brand-name clothing and featured major home appliance stores like Frávega, Garbarino, and Casa Márquez, CyC has more in common with informal markets like La Salada, with knock-offs of big brand garments and tennis shoes.

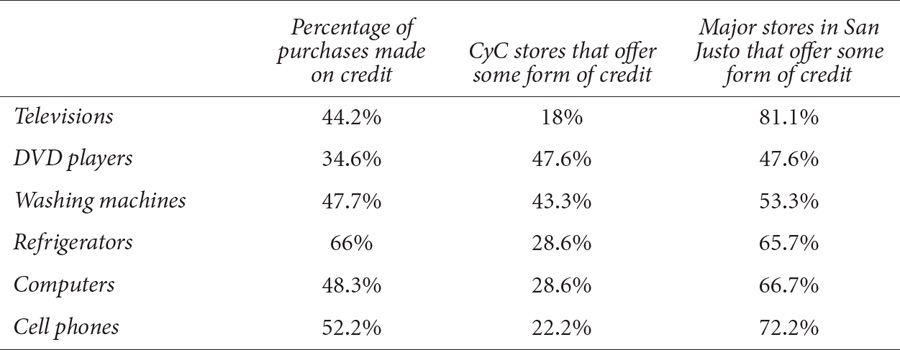

The one hundred adults that comprised the sample included inhabitants of the nearby slums. The survey was designed to gauge ownership of household appliances and personal devices; it found that between 70 and 100 percent of those interviewed owned cell phones, music players, refrigerators, washing machines, and televisions or DVD players. In most cases, credit helped them finance these purchases. Survey takers stated that they had used loans to purchase their televisions (44.2 percent), DVD players (34.6 percent), washing machines (47.7 percent), refrigerators (66 percent), music players (46.7 percent), and cell phones (52.2 percent). These indicators shed light on the expansion of the credit market:

In a seminal paper, the anthropologist Clifford Geertz (1962) proposed that the informal lending networks in Asia and Africa played a key role in the transition from traditional economic systems to modern ones. In such networks, Geertz argued, people adopt the economic ethics necessary to socialize in modern institutions such as banks. Bourdieu et al. (1963) also offered a consequentialist argument on the evolution of lending practices in France after World War II. For these authors, this expansion of credit helped shift economic behaviors and ethics from pre-capitalism to capitalism. Finally, in another pioneering work, David Caplovitz (1967) analyzed how informal lending practices among the poor constituted deviations from the formal system of the retail market.

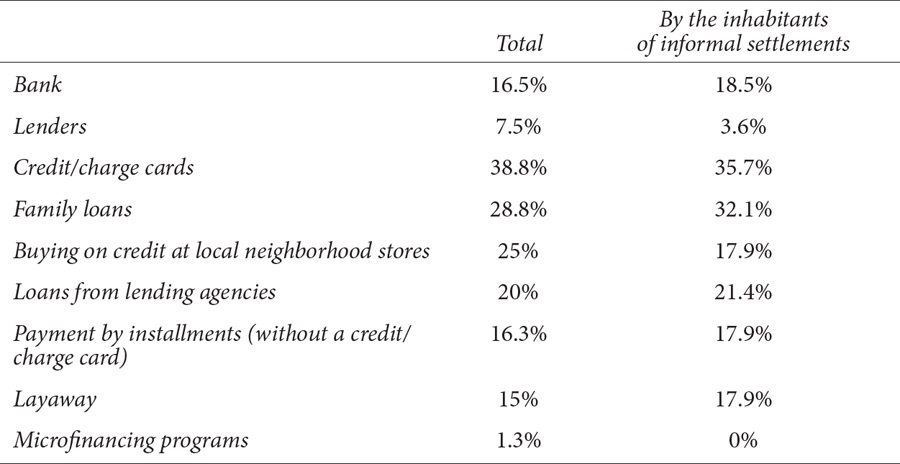

However, the data from the CyC survey contribute to a different interpretation of the way in which the credit market expanded among the lower classes in greater Buenos Aires. In addition to the rise in the money lent for consumer purchases, the social bonds and contexts of lending have become increasingly heterogeneous, as can be seen in the survey (Table 1). Those who took the survey reported many different lending options, such as bank loans and other types of formal credit (bank loans, credit cards, credit unions, installment plans at stores); informal financing (lending agencies, layaway); family financing (loans from relatives); neighborhood financing (buying on credit at neighborhood shops) or both (informal lending networks).

The fact that social lending bonds are so heterogeneous contradicts the argument that reciprocity networks are the most common source of financing. For the inhabitants of slums, financing can be based on interpersonal bonds (family assistance, buying on credit from local stores), but it can also be obtained on the expanding credit market, through credit cards and loans from lending agencies. These loans have fewer formal requirements than banks, although their interest rates are higher. Among the slum inhabitants who took the survey, 21.4 percent had requested loans of this kind (a percentage 1.4 percent higher than the total for the category of informal lending).

When considering all sources of financing, it becomes clear that microcredit from the government and NGOs is scarce. According to the survey percentages, credit has a major presence in the life of the poor, much more than public loans or NGO programs.4

TABLE 1. Use of credit in greater Buenos Aires (2009)

Source: Survey by author.

Unlike the consequentialist argument (Geertz; Bourdieu et al.) or the deviational argument (Caplovitz), the loan practices of those who responded to the survey combined both informal and formal credit. Their practices do not fit with a model that associates informal lending with backwardness and tradition, while tying formal lending to development and progress. The survey responses also deviate from the interpretation associated with normal systems (formal lending) as against deviant systems (loans to the poor).

The frequent use of credit cards and loans among the urban poor shows that credit has become a real possibility for nearly everyone: through the expansion of personal loans, financial institutions have absorbed those previously excluded from the banking system. However, this incorporation into the system has imposed particularly burdensome conditions on the poor.

Families in Debt

For Mauricio Lazzarato (2011) and David Graeber (2011), contemporary financial domination is represented by the figure of the indebted man. These authors suggest a new subjectivity that combines calculations based on the knowledge of credit technologies and one’s own moral responsibility in relation to the risk of accumulating debt. In this chapter and the next, I want to shift the focus from individual subjectivity to the collective dynamics of credit and debt. In this section, my main goal is to show that families—not just individuals—go into debt. The concept of moral capital helps unveil the dynamics of self-discipline within families in relation to accumulating debt. For this reason, I am interested in the thoughts and feelings that contribute to a belief in the virtue of paying debts in a context of greater pressure to take out loans even among low-income families. My interpretation suggests that families turn this pressure into a vehicle for moral distinction.

To develop this idea, I tracked eight households in an informal settlement in greater Buenos Aires, asking families to keep track of their income and expenditures for one month using a spreadsheet. I then conducted interviews with the families to discuss their finances at the end of the month. We’ll look at the percentage of debt in each household and later analyze the strategies each family uses to juggle their financial priorities (for comparison, in 2011, with a fluctuating exchange rate, from 3.4 to 3.8 Argentinian pesos were equivalent to a U.S. dollar):

These household budgets provide an objective view of the pluralist systems of lent money at work in household economies. The relationship between incomes and expenditures indicates the dependence on debt that stems from this plurality.

The credit story of the Pérez family illustrates this point. It all began when the main breadwinner, who worked at a butcher’s, became formally employed. In the past, every time the family had needed to finance a purchase, the head of the household would ask his boss to be his guarantor at local shops so that the family could purchase goods in installments. The man also had a charge card from a sporting goods store, which he had obtained by merely presenting his ID. Once his job situation was formalized, however, he was able to access different charge cards.

His wife, who had become a beneficiary of a welfare program, was now also able to get her own charge card. At the time of the interview, the couple had three cards. They viewed the plastic as an expansion of their ability to accumulate goods, even though all it contributed to the household budget was debt. Credit offered the couple an alternative when there was no cash, a way to compensate for not having any money set aside for a rainy day: “We don’t have savings but we do have debt,” as Maria Pérez would say.

For this reason, the possibility of consuming more by accumulating debt was viewed as both an opportunity and a threat. “You can live off the chapitas [cards] but you can’t breathe,” explained Maria. “You never get out of debt. But it’s the only way to live well, to have everything you need. I mean, how else would we celebrate the holidays? I don’t have a dime and I have to feed the kids. So how do I get by? The card. I go out and buy food or whatever else I need.” The interpretation that debt is “the only way to live well” can be seen objectively in the budget of the Pérez family. When the totals were tallied, debt represented 41 percent of their income.

The general expansion of credit alters the framing of calculations (Callon 1998). Debt is managed and incorporated as part of household budgets. It is assumed as a constant, and calculations take into account the higher prices that accompany the use of credit. Since these households are deeply in debt, families juggle their obligations to keep their budgets from becoming unsustainable. In the case of the Pérez family, this was achieved by choosing the maximum number of installments, thus paying higher prices in order to then take out other loans.

“I pay my bills and then I see how much money I’ve got left over. That’s how I get by,” was a phrase that echoed throughout the interviews. It was indicative of how important loan and credit payments were to the household economies of the poor. People make arguments, talk, do the numbers, and then make purchases in a process where financial stability is often disregarded. “We are never satisfied with what we have,” one informant told me. As soon as we’ve bought something, we already want something else. We are always going to be encuentado [drowning in bills]. Without the bills, you’ve got nothing. We can’t pay cash.” Being encuentado means assuming the predominant position of debt in the family’s economy. Relief only comes when a financial balance is achieved. “I’ve got no worries because I paid my bills,” as one interviewee put it.

Debt imposes its own rhythm on the circulation of money within the family. It involves all family members, either directly or indirectly. Just as consumption cannot be considered an individual act but is often organized as part of family obligations (Miller 1998), the debt burden is socialized as well.

“Credit cards are the only way for us to live well.” The people surveyed shared this conclusion, along with the virtue of maintaining good credit standing in order to be able to make retail purchases. Credit was a prerequisite for financing purchases and thus accessing the good life. From this perspective, certain family members are more responsible than others for preserving moral capital. The circulation of lent money carries an ethos of responsibility. Families think about credit and are aware of it every single day; debts are their vehicle for consumption. People who refuse credit are turning their backs on a better life. Once people are immersed in this economic and moral dynamic, they begin to emphasize the virtue of paying back what they owe. The financialized economic struggle creates a moral value for this (self-)recognition.

The Violence of Credit

As we saw in the previous section, families jealously protect their moral capital in order to gain access to the newly expanded consumer credit market. At the same time, they impose self-discipline on family members and socialize credit access and debt payment. In the stories I share in this section, I shift the focus from households to the stores and banks where moral capital alone serves as a guarantee for the money they lend to the urban poor. As will be shown, this strategy helps stores and banks competing against one another for low-income clients, who in turn exercise self-discipline in their finances in order to qualify for store and bank loans. Moral capital reveals how this dynamic between the supply and demand for credit forms the basis for power relations and moral hierarchies to access lent money. The Crovara and Cristianía retail area, just a few miles away from Villa Olimpia, serves to illustrate these ideas.

I visited Crovara and Cristianía for the first time in 2006. Analysts had focused on this intersection as the epicenter of the attacks on supermarkets and retail centers that had taken place during the hyperinflation of 1989, and later, during the explosion of the economic and social crisis in December 2001. In a context of profound economic recession, there were violent lootings of grocery stores, home appliance stores, and even clothing shops in poor neighborhoods around the country.5 Similar lootings have also occurred at critical moments in cities in Brazil, Venezuela, and South Africa over the past three decades.

I wrote these notes during fieldwork with a colleague in 2007:

We try to move along Crovara Avenue to drop off Tato and Walter, two members of the recycling co-op who live in the settlements near the avenue. The idea is to then continue on the road back to the city of Buenos Aires, but a group of one or two hundred people is blocking Crovara Avenue. They are milling around in front of a few shops. Expectation fills the air, as if something important is about to occur. Rumors that stores could be looted have been circulating all day. A policeman turns on his siren and the uniformed men keep a close eye on the protestors.

“We’ll get out here,” said Walter.

“Yeah,” agrees Tato. “We want to be here for these people.”

“No, stay with us,” we insisted. “We’ll find another way to get you home.”

However, the danger that we sense clearly does not affect these two men the same way. Tato winks his eye at us and says, “Don’t worry, we’ll be fine. There’s nothing to worry about.”

When they get out of the car, we realize that Tato and Walter probably want in on the action.

A few days later, we found out that they had stayed on the corner until midnight waiting for the looting to begin.

A trust had been broken because of past lootings. After that experience, how could local merchants sell on credit? What dimension of the financialization of the economy of the poor does this history evoke?

To answer this question, it is useful to consider the way in which the offer of credit expanded in a shopping area like CyC. While the credit selection was becoming more diversified in San Justo, it remained reduced and stagnant in CyC. In San Justo, people could opt for credit cards and loans through loan agencies; in CyC, few businesses worked with agencies and none accepted credit cards. The personal loan agencies were located in San Justo near the stores, but there were none around CyC.

This uneven access to credit was expressed in the overall sales percentage. According to San Justo retailers, between 30 and 40 percent of sales involved some form of credit, while at CyC, lending instruments of any kind were practically nonexistent. This was confirmed in the data gathered during a survey conducted at CyC. Table 2 shows that credit is used more frequently at major retail chains; its use drops significantly at other types of stores, like those in the CyC shopping area.

The offer of credit at stores in the two areas shows that the financialization of purchases is by no means the same everywhere. The stores that adapted to the rules of this new economic scenario (those in San Justo) sold more. The CyC, in contrast, was the place for stores that did not have enough capital to offer formal credit instruments.

The survey of the CyC retailers provides revealing information. The retailers reported that they did not offer cards or credits through lending agencies because this would reduce their earnings. The principal reasons they listed were the following: the monthly maintenance fee on bank accounts, credit card commissions, and the taxes that they would have to pay if sales were declared to the tax authority. In other words, the CyC retailers did not have the economic capital to compete with retail chains and other stores with a diversified, extensive selection of credit options for consumers.

In San Justo, the poor had access to several types of credit. While the large retail chains in San Justo catered to a group that could be described as “lower class with a payroll stub,” other retailers in this area offered credit instruments with no type of formal requirements. These instruments, however, were not available at the CyC stores.

The (Dis)Credit of the Lootings

Towards the end of 2009, the Argentine newspaper Página/12 ran a story entitled “Holiday Rumors.” “In La Matanza, rumors have been spreading over the past few weeks . . .” began the article, which reported that before Christmas, there would be lootings similar to those that had occurred at the peak of the economic crisis in December 2001. “The people who live here say they hear the same rumor every year,” continues the article, which describes Cristianía Avenue as the dividing line between two neighborhoods.

TABLE 2. Retail credit available to the inhabitants of informal settlements in greater Buenos Aires (2009)

Source: Survey by author.

The Página/12 article mentions the stigma associated with the neighborhood’s residents since the economic and institutional crisis eight years earlier. One woman interviewed, Rosa Carrizo, acknowledged that she had heard rumors about the looting from her neighbors and from the mothers of her son’s classmates at school. “Get ready,” they had told her. Another woman interviewed by the press, an older woman named Marita, had some tips for avoiding the crisis. “You know what I would do? What the right thing to do would be? Any merchant who’s afraid of being looted should get a bag of stuff ready to give to the needy. They wouldn’t be any the poorer.”

The prejudice suffered by the residents of the neighborhoods near CyC reasserts the crime and laziness often associated with the poor. When asked to describe their customers, one CyC merchant said, “They’re all lazy. They come by in the morning, in the afternoon . . . No one works. They live off welfare.” These two beliefs forged a retail relationship based on discriminating against the customer, a discrimination exacerbated by the looting of local stores.

The memory of the violence among local merchants could be seen in their everyday treatment of customers. “The store windows have been covered with bars since the lootings in 2001,” reported the newspaper. The wife of an owner of a local clothing store was a good example of how this relationship played out, according to one resident: “After the looting, there was a lot of resentment. Everyone was thinking, ‘Oh, sure, now you come to shop here . . .’ The merchants on this block defended their businesses and once the danger had passed, they had to open their doors to those who had looted their stores. They had to just accept it. So it wasn’t only about cutting their losses, it was about dealing with the anger,” she explained, adding, “Take the owner of this place next door—she never waits on anybody. The store can be packed with customers, the employees running around trying to do everything and she won’t even take the money when a customer wants to pay. She doesn’t want to wait on them. She feels betrayed. We know who was responsible. Here we all know each other.”

The merchants felt “anger,” “resentment,” and “indignation” towards their customers, but they also depended on them. In the words of one shop owner, “We have to swallow our pride.” “Why don’t they close up shop here and open up someplace else?” I asked her and others. For many of these people, their economic capital kept them from abandoning this retail space. The rentals on shops in downtown San Justo could cost triple those of CyC. The question, then, was how to provide credit instruments to customers who provoked “indignation,” “resentment,” and “anger” while providing financing to make their stores more competitive.

Given this panorama, it is no coincidence that lending instruments are so rare in CyC. However, certain credit practices enabled merchants both to boost their sales through financing and minimize the risk of providing credit to “untrustworthy” customers.

Layaway was a new practice that adapted to this retail configuration. For relatively inexpensive products such as clothing or shoes, the down payment and pickup could take place in a single month; for more expensive products such as furniture and home appliances, customers could take up to four months to finish paying for the item. Paying the original sale price with no markup depended on the store and on the item: for relatively inexpensive products, the price remained the same, since the purchase was completed within a month or so. For more expensive items, the price could be adjusted for inflation, depending on how long it took the customer to pay for them.

The customers’ lack of cash and the fact that they had no access to formal financing cast them in a bad light for vendors; in addition, customers were seen as having no morals. The result was a payment instrument (layaway) in which the trustworthy subject was not the borrower but the lender.

Unlike other credit practices based on the credibility of the borrower, who must provide evidence of being creditworthy, layaway works in exactly the opposite way. Through this payment instrument, customers can never become trustworthy subjects. Layaway strips agents of the moral capital they would need to enter into a credit relationship. Instead, retailers are entrusted with all the aspects of the marketplace transaction: keeping a record of payments made, maintaining or increasing the price, and assuring that the product will be in stock when it is paid off.

“People leave here with a slip of paper—it’s not a receipt,” explained an employee at one of the shops. “Anyone who’s finished high school knows not to leave without a receipt, but for them, it’s the only way to buy.”

The buyers took two risks. If the price of the product went up, they would pay more for it. And when they were ready to pay off the product, it might or might not be in stock. Buying on layaway was a race against time to avoid these risks as well as the high cost of financing. For retailers, a moral rupture had been branded into their memory when they had seen their usual customers join in the lootings. “I saw guys looting who come in here and spend two hundred pesos on pants,” said one retailer. “They weren’t looting because they were hungry—they were taking everything they could,” said another vendor, in reference to those who made off with alcoholic beverages and home appliances. Layaway was thus the economic cost of the negative moral consequences of the lootings.

Trust and Credit

On the opposite side of this devaluation of the moral capital of those who live in the neighborhoods surrounding CyC, there was another credit relationship that sustained a collective moral capital over the years. This story links the inhabitants of Villa Olimpia with a home appliance retailer in San Justo.

During my fieldwork in the neighborhood, the name of one store came up over and over again: Obrihogar, which had been in San Justo since the 1960s. Even in casual conversations, the interviewees mentioned a home appliance purchased on some type of credit at Obrihogar. Their relations with this store went back years, when one of the owners visited Villa Olimpia to offer the store’s products in installments. This practice laid the foundation for the residents to purchase at Obrihogar using informal financing. “We go where [the major home appliance chain] Frávega doesn’t go,” said Omar when asked what distinguished his shop from its competitors. He was not speaking of physical distance—Obrihogar is located on the same block as a Frávega branch—but of symbolic distance.

Frávega will not offer credit to anyone who cannot provide a payroll stub. In contrast, Obrihogar offers its customers a triple incentive: a less hostile retail space (“Just imagine—people come in here in their work clothes. How do you think they feel at Frávega when the employees come over to them in uniform?”); credit without proof of earnings; and sympathy when customers fall behind on installments.

Being from the neighborhood is an incredibly important resource when it comes to believing that the borrower will pay back what he/she owes and is trustworthy. “Villa Olimpia residents pay what they owe,” said the owner of Obrihogar. “But those who live in Villega de Santos Vega (another slum in La Matanza) are not as likely to pay.”

Sustaining this moral judgment means thinking about a social network that allows Villa Olimpia inhabitants to purchase on account at Obrihogar. This network imposes a responsibility on neighborhood residents, since the discredit of not paying back a debt could jeopardize Villa Olimpia’s status as a community that pays its debts. Given that existing customers introduce new customers and serve as guarantors, the social network acts as a filter, maintaining the credit rating that the neighborhood has earned at the store. Not all residents access this guaranteed introduction—only those who meet the prerequisites.

Maintaining initial moral judgments within the framework of stable social networks makes creditors better at anticipating what borrowers will do. At the same time, borrowers are more likely to protect this moral capital, since it is the only guarantee they have to offer lenders. In this credit system, other types of guarantees are subordinate to moral capital. The absence of reliable information on income, job status, or credit history leads people to prioritize interpersonal trust in order to reduce uncertainty. Alya Guseva (2008) has analyzed a similar mechanism at work in the expansion of the credit card market in Russia.

This credit system can be interpreted by the way the store has worked to form bonds with the poor and offer them some type of financing. At the same time, credit is configured within individual customer relations, which reveal different possibilities for the use of credit instruments. Depending on the size, sales volume, and type of customer at each store, stores such as Obrihogar have been able to use moral capital to compete with major retail chains. The concept of moral capital thus entails different prerequisites for credit in large chains in comparison to small businesses, revealing how difficult it is for the most disregarded social sectors to access loans.

This unequal access to credit appears when reconstructing the social history of retail stores and the social basis for positive and negative opinions of borrowers among merchants. The study of the commercial configuration among Villa Olimpia residents and the Obrihogar store shows how the virtuous circle of moral capital can work.

The Heart of Capitalism

In this last section, I hope to show that this moral dimension of financial practices does not run counter to capitalist practices. The economization of morality (Çalışkan and Callon 2009) is a transaction that takes place not only along the margins but also in the heart of financing. This can be seen in the strategies used by banks to attract low-income customers.

“Hello. I would like to see about a loan,” I told the employee at a credit agency in San Justo.

“Do you have a payroll stub?” asked the employee from behind a glass window.

“Yes.”

“How long have you had your job?”

“About two years.”

“Where do you live?”

“In Buenos Aires.”

“Sorry . . . We only provide loans to people who live close by.”

“Isn’t Buenos Aires nearby? I came in here because I work near here.”

“No, no. It’s only for people who live nearby . . .”

“And why do you only provide loans to people who live nearby?”

“I don’t know. That’s the way the agency works. It’s not up to me.”

“OK then. Just to get some more information: how much money do you lend at a time?”

“Four hundred pesos the first time and six hundred the second.”

“And how much are the monthly payments?”

“Two hundred and forty-five pesos . . .”

However, I could tell the conversation was over as soon as the employee realized that I did not meet the prerequisites for the loan. Her eyes shifted to her computer monitor and she hurried to answer my last questions. Though she did not become unfriendly, she clearly wanted me to leave as soon as possible.

At the personal loan agency I visited in San Justo, the loan request process and credit approval was highly impersonal, a simple yes or no. The exchange between agency reps and potential borrowers was limited to a list of the required guarantees (an identification card and payroll stub), a phone call to confirm the applicant’s address, and a few brief questions about paying back the loan. What made this offer attractive was that the application was approved or denied so quickly. Anyone who did not have the documentation to prove who they were or how much they made was instantly informed that they did not qualify.

The distribution of space within the agency contributed to the process. The customer service windows were located all in a row and those waiting to speak with a rep stood in line right behind the person at the window. This meant that everyone could hear the conversations between the employees and the customers. This layout eliminated any privacy that would allow for more personalized treatment, as if to reiterate that this agency was only interested in a person’s ability to prove where they lived and how much they made.

With this documentation, the loan amount is calculated in an economic transaction based exclusively on how much a person earns according to his/her payroll stub. The agency rep does not serve as an economic advisor or counselor but merely checks to ensure that the applicant meets all the prerequisites. These reps have no autonomy, as can be seen in the employee’s response to me: “I don’t know. That’s the way the agency works. It’s not up to me.” This work method avoids personalized treatment altogether.

The process by which private institutions other than banks provide personal credit is highly indicative of how the poor have been incorporated into the financial system. Based on the interactions between the borrowers and the institutional representatives, objective and impersonal evaluation methods are used. Potential borrowers must present evidence of job stability and domicile (Lazarus 2011) and provide guarantees that they are moving towards a predictable future. The expansion of this personal credit market would seem to exclude moral capital from among these guarantees.

The development of technologies for evaluating borrowers shows a trend towards objective, quantifiable methods like scoring or rating systems (Marron 2007). This, however, does not capture the ubiquity of morality in lending systems. Fieldwork notes I took at another bank with lending strategies aimed specifically at low-income customers are particularly instructive in this regard.

“We also consider the way people live, no matter how poor they are. You can live in a slum or in a house built out of cardboard but still keep things neat. That says a lot about someone, about how responsible they are,” Mario explains.

Mario is not a Catholic volunteer or a social worker who visits the slums. He is an employee at Elektra, a credit agency and home appliance sales company that is a subsidiary of Banco Azteca, which belongs to the powerful Mexican economic group Salinas. It is Mario’s job to evaluate whether to give someone credit so they can purchase a home appliance. His assessment is not done from behind a glass window in an impersonal office: he visits the home of the applicants, where he is able to assess minute details of their personal life and values.

Banco Azteca was founded in 2002 in Mexico, where the bank has 1,500 branches and 15 million customers. Branches soon opened in other countries of Latin America, including Brazil, Peru, Guatemala, Honduras, and Panama. The bank has operated in Argentina since 2007 under the trade name Elektra. Unlike large banks with branches in downtown Buenos Aires, the first branch of this financial institution and home appliance store opened in the low-income neighborhood of Laferrere. Elektra now has another thirty branches. In order to adapt to a small economy, it offers loans that can be paid back in weekly installments. At the stores, instead of showing prices, signs show the number of installments with interest rates that range between 60 and 110 percent. The agencies also offer cash loans and money transfers.

In cases like Elektra or FIE Gran Poder—another company that offers financial products to low-income people in Bolivia and Argentina—offering credit to people excluded from the banking system means redefining the poor as consumers. This strategy was accompanied by a particular type of credit scoring. One of the features of credit approval is having trained personnel such as Mario visit the homes of the applicants to assess their environment. The principal aim of these visits is to establish a personal bond with the applicant, conduct a moral evaluation and get an idea of his or her private life.

“It’s important to gauge how friendly people are, because we have to be able to enter their house. This is one of the barriers we have to overcome: making people trust us enough to let us in. There are people who leave you standing in the living room and you have to use your arm to write on. Then there are others who invite you to sit down, offer you a glass of juice or water.”

Not everyone Mario sees has good manners. “That also lets you know how people really are—being polite, no matter how poor. You can sound out what these people are like. In general, the polite ones pay back their loans.” The main purpose of Mario’s visits is to establish a personal bond with the applicant, conduct a moral evaluation and get an idea of how they live.

Elektra combines different guarantees (economic, legal, and moral) and ranks them according to importance. It has constructed a market niche by selecting customers with few legal or economic guarantees but strong moral ones. Financing agencies like these publicize the fact that their lending is based on the guarantee I refer to here as moral capital; in other words, they make the recognition of moral virtues into standardized procedures. Moral capital is thus located at the core of capitalist finances—not on the fringes.

According to C. K. Prahalad (2005), Elektra is the kind of company that sees a business opportunity in the people at the bottom of the pyramid. Prahalad argues that this is a profitable enterprise because of the poor’s enormous and generally unexploited capacity for consumption. Based on success stories like that of Elektra, major companies should stop viewing the poor as underprivileged and instead treat them as a potential market (Elyachar 2012).

Mario describes a typical customer as follows: “The men generally work in construction and the women as maids or seamstresses. They are part of the informal economy.”

“How much money does the company lend someone?”

“Between five hundred and two thousand pesos if they don’t have a way to verify their income. If they can verify their income, up to three thousand five hundred. Yesterday I saw a fellow who sells sausage sandwiches. He wants to clean up his cart, make it look nicer, and two thousand pesos is plenty for him. At the same time, that’s the perfect amount for us to lend, knowing he will be able to pay us back. Most are cases like his.”

An executive from FIE Gran Poder describes their credit assessment as follows: “The technology we apply here was tried and tested in Bolivia. We do interviews with friends and relatives to determine whether the person is trustworthy. We try to measure their willingness to pay and in this regard, the family plays a very important role. Being late on payments increases when there are family problems” (Sainz 2009).

While the dominant narrative of the expansion of the credit market tends to depict credit classifications as depersonalized and invisible, with a focus on economic and legal guarantees, here we discover exactly the opposite: a face-to-face, highly personalized interaction where moral virtues are assessed. In this credit relationship, other types of guarantees are subordinate to moral capital. Moral capital sheds light on the forces at work within the thoughts and feelings associated with credit.

Now Mario describes his ideal client: “He doesn’t have a payroll stub. He does any old job and gets paid on a daily or weekly basis. He handles a bit of money, not much, but he isn’t able to improve his living situation because he doesn’t know how to save or get loans. The first time a customer told me, ‘You’re helping my dream come true,’ I thought he was exaggerating.” Pausing for a moment, Mario then added, “But over time, experience taught me the contrary: these people have a dream, something they’re after. The customer I am looking for is someone who doesn’t usually qualify for credit and we give him or her that possibility. At one training session, I was told that a customer makes sure to pay off a loan when it helps him make a dream come true: a dream like owning a television and a DVD player so he can watch movies.”

Mario’s words reveal the figure of the poor meritocrat positioned at the heart of capitalist finance. “That is why the lower classes are the ones who take credit so seriously.” Mario, in fact, has no interest in a customer who makes ten thousand pesos per month but never makes a payment.

“We’re looking for profit. I’m good with the guy who gathers cardboard, gets by and pays me a fifty peso weekly installment. The ones who come in with a payroll stub are the ones who fall behind; some of them say, ‘I can’t make the payment because I’ve got to throw my daughter’s fifteenth birthday party.’ There are customers with a high credit rating who suddenly disappear . . . Once I went to see a guy who was avoiding me and I drove my scooter right into his garage because I was so angry. I am talking about company workers, factory supervisors, people who earn a decent salary . . . They’re the ones who fall behind.”

The success of this credit relationship depends on the belief in the credit-scoring technology described by Mario. One of the conditions of this belief is the conviction that formal, economic guarantees alone do not provide a solid basis for approving a loan. Sometimes this type of loan assessment is based on forming a bond with applicants whose “dreams will come true” if they are approved.

Mario insists: “These are people who cannot access credit and our company gives it to them, so they work hard to pay us back. It’s a pleasure to help them. And if they don’t make a payment, it’s because something’s gone wrong. I have cried alongside my customers when a serious problem comes up and they can’t make a payment.” The relationship, according to Mario, went beyond the usual one between a loan agent and a borrower. “I can now call many of these people my friends because they help us and I help them. When you help out people like this, they are on your side for life. Because they are careful with a loan—it’s their only chance to buy a cell phone or a television set or whatever. That is why the poorest people are our best customers.”

Mario’s account has a precise performative value. It establishes a certain morality required to participate in this credit system. This implies a preconception of both the moral value of the meritocratic poor and the technical and emotional capacities for discovering this value. Mario was trained to believe in both preconceptions that give shape to this credit system.

These credit relationships may provoke discomfort. Like other alternative financial forms such as microcredits, they extend credit to those who have none, thus democratizing money. On the other hand, without demanding a more ethical economy, they economize moral virtues. But do they use other means to achieve the goals of alternative financing? If the practices that have been defined as “alternative” can adopt the features of the dominant financial practices (Maurer 2012), the opposite can also occur: dominant practices can take on the features of alternative financing. These “poor people’s banks” shake the very foundations of “alternative financing” and suggest that the relationship between economy and morality is not a formula but an enigma.

In this first chapter, an initial inquiry into the meanings of money in the life of the poor led me to discover the piece of money lent. Instead of fitting perfectly into a unified and stable reality, though, it itself is a puzzle, incomplete and open to exploration. For this reason, the chapters that follow delve deeper into the meanings of the piece of lent money as new pieces of the puzzle are unveiled.

In a work that deconstructed Max Weber’s myth of the capitalist spirit, the historian Craig Muldrew (1998) analyzed the origins of capitalism in England to show the importance of a credit as a “cultural currency” based on trust and a household reputation. Muldrew’s work is quite similar to anthropological studies that attempt to explain the social and moral profiling that occurs in contemporary financing (Zaloom 2012; Ortiz 2013). Both approaches deconstruct the one-sided narrative of the morality of credit and debt. My work has moved in the same direction, seeking to deessentialize the opposition between informal and community-based systems and so-called capitalist systems. Instead, I reveal their similarities, showing that both systems require individuals to accumulate moral capital as a way to access credit and pay off debts.

Here we have seen the moral ubiquity of money lent in both the formal and informal situations where money circulates. I have also revealed how moral capital becomes a guarantee that sustains the power relations at the core of these situations. As we have seen throughout this chapter, for those with scarce economic and cultural assets, struggling to have one’s values acknowledged is part of daily financial management. Moral capital is a passport. However, like all forms of acknowledgment, it is rare, which means that in order to access the material benefits capitalism has to offer some are forced to accept disadvantageous terms, like those of layaway. The hypothesis that moral capital multiplies economic capital suggests that there are inequalities among borrowers as they compete for moral distinction.

This chapter has focused on one of the dynamics that shapes the economy of the poor: the recent expansion of the lending market. The next chapter analyzes the power relations through the moral dimension of money earned on informal and illegal markets.

1. To compare this process with that of other countries in Latin America, like Chile, see Ossandón 2012.

2. Source: Central Bank of Argentina.

3. The use of credit cards in Argentina tripled between 2004 and 2011, from five to fourteen million credit cards nationwide.

4. This point is worth noting, given the growing interest among both scholars and politicians in microcredit programs organized by the government, NGOs, and multilateral credit agencies (Schuster 2015).

5. For the episodes of 1989, see Salvatore 1995 and Neufeld and Cravino 2001; for those of 2001, see Auyero 2007.