OVER THE YEARS I have begun to question the business education we are giving to young people. This has been a gradual process, but two incidents stand out to me vividly as emblematic of my concerns. The first involved WorldCom CEO Bernie Ebbers, who in 2005 was convicted of fraud and conspiracy and sentenced to a twenty-five-year prison term. It was the largest accounting scandal in US history (until Bernie Madoff’s Ponzi scheme was uncovered in 2008). I remember Ebbers’s sentencing well, because I had just joined the faculty at the University of Michigan’s Business School and was struck by the fact that no one was talking about it. Ebbers was a man who would have been held up as a model of success for our students, building the second-largest long-distance phone company in the country. But now he was a disgrace. It was not until the end of the day that the silence was finally broken. I walked onto an elevator and overheard a memorable conversation between two senior colleagues of mine: “What do you think of the Ebbers sentence?” one professor asked. “I think it’s ridiculous,” the colleague replied. “It’s not like he killed someone.”

The second happened four years later and involved an executive from General Motors who had come to the University of Michigan in search of a new position. GM had just been bailed out by the government; Frederick (“Fritz”) Henderson had been named CEO, but many thought that his role was merely that of “interim” CEO and his term would be brief. As a result, some of his staff had begun to look for escape plans. When this executive interviewed with several faculty, including me, he said something that really struck me. He said with a smile that he had been at GM for thirty years and “really had a ball.”

To me, the Ebbers incident speaks to how we as a society do not hold business people accountable; it illustrates the disconnect between the power that business executives possess and the responsibility that comes with that power. Ebbers did not commit actual murder, but he caused extraordinary hardship and pain for the company’s employees, customers, suppliers, buyers, and investors, who lost millions of dollars because of his actions. WorldCom’s stock lost 90 percent of its value in days, dropping from 83 cents to 6 cents per share, and its Chapter 11 filing made it the largest bankruptcy in history. Many legal experts have deemed the sentence fair.1

The GM executive incident illustrates how business people don’t even hold themselves accountable. I was amazed that this executive could say that he was part of the leadership team that almost destroyed GM and that he enjoyed it. It was like a doctor coming out of an operating room where your parent is undergoing surgery and telling you that he had botched the operation, your parent almost died, someone else had to take over, but he “really had a ball” while it lasted.

I am not alone in questioning how business leadership is being practiced in the market today. Corporate attorney James Gamble wrote in 2019 that many of our business leaders are compelled “to act like sociopaths,”2 running their company as “a textbook case of antisocial personality disorder” in which it “is obligated to care only about itself and to define what is good as what makes it more money.”3 That same year, Marc Benioff, CEO of Salesforce, asked his “fellow business leaders” to wake up to the reality that “capitalism, as we know it . . . with its obsession on maximizing profits for shareholders . . . is dead.”4 Economist and Nobel Laureate Joseph Stiglitz warned that the way we practice business today is “exploitive” and that “the neoliberal fantasy that unfettered markets will deliver prosperity to everyone should be put to rest. . . . The rampant dishonesty we’ve seen from Wells Fargo and Volkswagen or from members of the Sackler family as they promoted drugs they knew were addictive—this is what is to be expected in a society that lauds the pursuit of profits as leading, to quote Adam Smith, ‘as if by an invisible hand,’ to the well-being of society, with no regard to whether those profits derive from exploitation or wealth creation.”5

These criticisms could also be directed at the education system that helps shape and reward our business leaders, and in recent years there has been a wave of opinion pieces and books that are doing just that—many written by former students themselves. “Elite business schooling is tailored to promote two types of solutions to the big problems that arise in society: either greater innovation or freer markets,” MIT Sloan School MBA student John Benjamin wrote in a searing 2018 New Republic article, adding “Proposals other than what’s essentially more business are brushed aside.”6 In a 2019 American Affairs essay, Harvard Business School graduate Sam Long described an educational system that produces “a business elite dominated by financiers and their squires, presiding over a disordered economy gutted of both its productive energy and the ability to generate mass prosperity.”7

Business journalist and writer Duff McDonald excoriated the business school environment in 2018, writing that the business curriculum is devoid of normative viewpoints, “has always cared less about moral leadership than career advancement and financial performance” and as a result, creates “a generation of corporate monsters” who lack “a functioning moral compass.”8 Also in 2018, Martin Parker, professor at the University of Leicester School of Management, charged that “we should call in the bulldozers and demand an entirely new way of thinking about management, business and markets.”9

These critiques come at a time when capitalism is in crisis. One symptom of that crisis is income inequality, which is growing to epidemic proportions not seen since 1929. In 2016, the United States attained a Gini index, a measure of an economy’s equality, of 41.5 (up from 34.6 in 1979), which ranks it as more unequal than India, Kenya, Russia, and the Philippines. This is a social crisis that capitalism both caused and seems unable to address. A second symptom lies in our natural environment, as global greenhouse gases are at their highest-ever level and show no signs of declining. The resulting climate change, coupled with the unrelenting destruction of natural ecosystems, led the United Nations to estimate that more than a million species are at risk of extinction. In fact, the human impact on the natural environment has reached such a level that scientists have proposed that we are now entering the Anthropocene; a new geological epoch in which we cannot describe the environment without including the role that humans are playing in influencing how it operates.

Growing segments of the population blame business leaders and other global power brokers for causing these problems. “We are in the beginning of a mass extinction. And all you can talk about is money and fairytales of eternal economic growth,” sixteen-year-old Swedish climate change activist Greta Thunberg accused world leaders and executives at the United Nations Climate Action Summit in September 2019. Few were sympathetic to those executives, as polling from the Pew Research Center finds that large majorities of Americans believe our economic system unfairly favors powerful interests.10

While I understand where feelings of distrust in the economic system are coming from, I don’t think it’s completely productive to heap all the blame for our era’s crises on business and the market, looking for someone else to fix it. We are all complicit in the consumption and growth patterns that are feeding the social and environmental problems of our day, and many of us work in the very businesses we blame. We are facing systemic problems that require systemic solutions, and the pragmatic reality is that we must turn to, and work with, the market to solve these challenges. The market—comprising corporations, the government, and nongovernmental organizations, as well as the many stakeholders in market transactions, such as consumers, suppliers, buyers, insurance companies, banks, and so on—is the most powerful organizing institution on earth, and business is the most powerful entity within it. Though government is an important and vital arbiter of the market, it is business that transcends national boundaries, possessing resources that exceed those of many nations. Business is responsible for producing the buildings that we live and work in, the food we eat, the clothes we wear, the automobiles we drive, the forms of mobility we employ, and the energy that propels them. Indeed, if there are no solutions coming from business, there will be no solutions.

Business, for example, is developing the next generation of renewable energy, driving the average installed cost of wind power from 7 cents per kWh in 2009 to below 2 cents in 2019; wind power contributed 6.5 percent of the nation’s electricity supply in 2019 (providing more than 10 percent in fourteen states and more than 30 percent in three states: Kansas, Iowa, and Oklahoma).11 Similarly, innovations in solar photovoltaic power have led to a dramatic 99 percent decrease in price between 1980 and 2012,12 leading to projections that solar power could climb from 7 percent of total US renewable generation in 2015 to above 35 percent by 2050.13

These examples do not mean that only business can generate solutions. Government policies can spur the market, and individual choices can feed it. But with its extraordinary powers of ideation, production, and distribution, business is best positioned to bring the change we need at the scale at which we need it. Without business, solutions will remain elusive. And without leaders who are willing to challenge taken-for-granted norms and conceive of a new vision for the corporation, such as Rose Marcario at Patagonia or Paul Polman at Unilever, business will never even try to find them. In fact, a 2017 survey by the Global Strategy Group found that 81 percent of Americans want businesses to “take action to address important issues facing society.”14

But it’s also apparent to me that those solutions will not be as visionary, transformative, or rapid as our world requires unless we change the business culture that produces them. To do that we must seriously rethink what students learn in business school. While business schools have made small and halting attempts over the years to address the misalignment between society’s interests and those of business, they have not been enough. For example, two standard answers are to teach business students about ethics or the legal implications of corporate wrongdoing. But the first often strives to instill new values on fully formed adults or teach ethical reasoning to students who are paying a lot of money to learn other topics. The second only sets a worst-case baseline and does not inspire future business leaders to be their best, to achieve great things for their companies and for society. Both are isolated electives in an overall curriculum that teaches shareholder primacy above all else. Another answer is to ask graduating business students to sign an MBA oath at graduation time—a sort of management Hippocratic Oath to do no harm—that commits them to “create value responsibly and ethically” for the greater good.15 While a nice idea, this oath comes late in the education process and with little preparation for what such an oath means. In truth, it often means little more than virtue signaling with no real accountability.

It is my belief that the prevailing business curriculum and its underlying philosophy need a profound overhaul. Our schools must teach students about the basics of business management. But they must also teach them to seriously consider the vast power that they may someday possess to shape and guide our society, and learn the responsibility to wield that power carefully. Tomorrow’s business leaders should be taught to do something that previous generations rarely did: they must start thinking critically about the role of business in society, their role as a manager in guiding those businesses, and the overall system in which they will practice their craft—capitalism. They should be taught to look deep inside themselves to consider management as a calling—one that moves away from the simple pursuit of a career for private personal gain and toward a vocation that is based on a higher and more internally derived set of values about leading commerce and serving society.16 It is about connecting your career with your conscience. As James Gamble writes, “power needs to be constrained by conscience.”17

The process of developing that conscience and exploring one’s calling cannot be accomplished simply by adding electives to the program. It requires a new approach to the curriculum, one that begins with a process of discernment by which students are both charged with a system of aspirational principles and encouraged to explore their own. Unfortunately, today’s business education allows no such reflection. Classes, clubs, social activities, and the hunt for the first summer internship dominate their attention from the moment they arrive on campus.

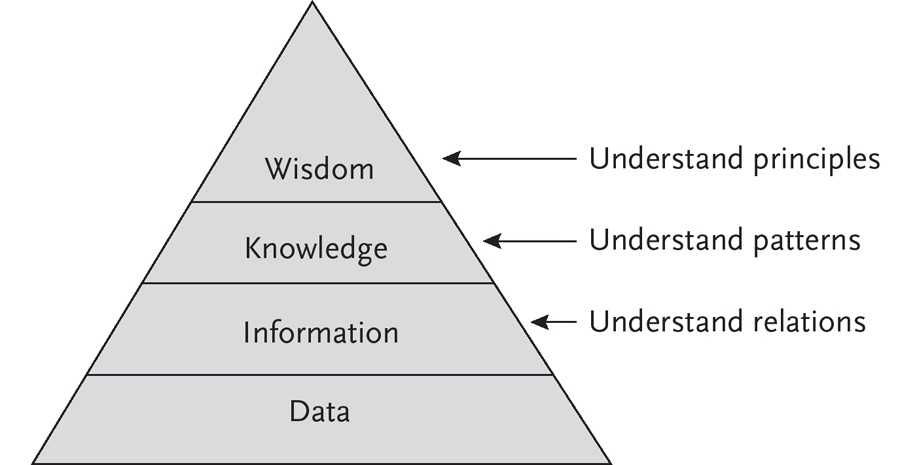

The pursuit of a calling leads to the careful cultivation of wisdom, something lacking in today’s business education. Business schools teach knowledge. This is what fills our research journals, and it is driven by theory and analysis that helps us first turn data into information and then turn that information into knowledge. The first step takes data in the form of artifacts, symbols, and information and examines relations for creating categories of information for analysis. The second step takes that information and examines patterns that allow us to develop useful “know-how” (see Figure 1).18 But to turn that knowledge into wisdom requires one more step of an appreciation for principles.

The truth is that wise business leaders do not make decisions based solely on patterned information, regression analyses, and p-values. Instead, she or he assesses that knowledge and makes a decision based on wisdom, character, judgment, and integrity. Many of the problems we face in today’s world are caused by applying knowledge without wisdom; “we act but we do not act wisely.”19 Developing the whole student, cultivating wisdom and character, requires a set of aspirational principles that guide the business education: how it selects and socializes its students; structures the curriculum, co-curriculum, and pedagogy by which they are molded; invites recruiters for placing them in positions of leadership; chooses the role models to elevate as exemplars of the principles they seek to reproduce; accepts donations that often leave a physical and cultural imprint on their facilities; and guides the research and rewards of its faculty.

Guided discernment, as part of that education, would counter the herd mentality that the pressures of business education create, leading to more focused, balanced, and mature students who will be thoughtful about why they are pursuing this education and how they might choose to direct it toward a career that is personally, professionally, and socially meaningful. Students need to be taught to become pillars of commerce that serve their shareholders, employees, and society, in a spirit of service similar to which we use to train doctors and lawyers. It is about embracing a revitalized set of professional and moral ideals. It’s about developing conscience and character. And I would add an important addendum: if business schools do not provide this training in any formal way, students should take the initiative to add that content themselves. Today, many are doing just that by demanding more course content on sustainability and social impact.20 But there must be more.

Twenty years ago, students who wanted to change the world turned to schools of public policy and nonprofit management for their training. Today, many are turning to schools of business management, and they are bringing with them a desire to explore a new sense of the economic, social, and environmental purpose of the corporation and their role as leaders. One survey found that 67 percent of business students want to incorporate environmental sustainability considerations into whatever job they choose;21 another found that 88 percent of business school students think that learning about social and environmental issues in business is a priority and 83 percent state they are willing to take a salary cut for a job that makes a social or environmental difference in the world.22 By 2019, business ethics had entered the top five most popular subjects for the first time, with nearly 25 percent of incoming students wanting a job focused on social impact after graduating and nearly 50 percent wanting to do so later in their careers.23 Whereas previous generations of business students were exposed primarily to the idea that business should only be concerned with increasing profits for the shareholder (articulated most famously by Milton Friedman from the University of Chicago and Gordon Gekko in the movie Wall Street), many of today’s business students show an interest in moving beyond such a narrow view and dedicating their careers to making a difference in the world.24

But business programs are not keeping pace with this reality. In his New Republic critique, MBA student John Benjamin argued that the curriculum stifles discussion of the common good while emphasizing the overriding objective of profit maximization as unquestioned. Rather than cultivating open-minded stewards of the economy, he argued, it teaches students to ignore shareholder capitalism’s obvious ethical lapses and avoid any kind of systemic analyses of it.25 Indeed, many students seem to graduate with a narrower understanding of business than when they entered the program. According to Craig Smith, professor of ethics and social responsibility at INSEAD, “Students come in with a more rounded view of what managers are supposed to do but when they go out, they think it’s all about maximizing shareholder value.”26

I watch my students struggle with these pressures. Many start their business education with aspirations to eschew big salaries and work to pursue social good no matter the income. And then they are immersed in a curriculum that walks them through a standard set of courses on economics, strategy, accounting, finance, operations, marketing, and organizational behavior, each built on a common underlying set of values that elevates profits, efficiency, and growth as unquestioned goods. One student told me that she felt that her values were under attack every time she walked into the building. This overriding culture and value set steers many into jobs they may not really want. William Deresiewicz lamented in his 2014 book Excellent Sheep that too many students are being shepherded toward jobs in consulting or finance because the worth of a college education is increasingly measured by “return on investment,” with “return” measured as some “vaguely understood objectives: status, wealth—‘success,’” which usually translate into money.27

When students approach graduation, they look at the salaries that large consulting firms are offering peers and begin to bend from their former ideals. For some, it is the simple cultural cue that money signals status and success. For others, the process is much more pragmatic. In 2019, the median starting salary for an MBA graduate was $110,000,28 while the top consulting firms offered an average of $165,000 per year with a starting bonus of $65,000.29 This enticement can be too much to turn down, and some have little choice. College simply costs too much money, and they amass such large debt loads that they feel trapped. In 2019, a Bloomberg survey found that almost half of students at leading business schools borrowed at least $100,000 to finance their two-year degree.30 And that creates a strange irony; we teach students how to become entrepreneurs and then saddle them with so much debt that they cannot afford to be entrepreneurs. In fact, research has shown that as student debt increases, the likelihood that a student will embark on a career in entrepreneurship declines.31 To deal with the debt crisis, some accept high-paying jobs with the promise that they will leave once their student loans are paid off. But all too often, their cost of living soon includes homes, cars, vacations, retirement accounts, health care, and their own children’s ballooning college costs, creating chains that hold them back from keeping that promise.32

Many will not even know that they have drifted from their previously noble goals, moving into gated communities behind protected walls, isolating themselves from the problems for which they begin to see no responsibility. They simply follow where they are led, neglecting the failures in the system that is rewarding them individually by damaging society as a whole. I remember once telling a successful investment manager that I wrote about ways in which the market can shift to address our sustainability challenges, and he dismissively replied that he didn’t care about changing the market, adding, “I just want to know what the rules are, and beat the next guy [sic] at them.” Martin Parker warned, “If we teach that there is nothing else below the bottom line, then ideas about sustainability, diversity, responsibility and so on become mere decoration.”33

1. P. J. Henning, “White collar crime sentences after Booker: Was the sentencing of Bernie Ebbers too harsh?” McGeorge Law Review 37 (2006): 757.

2. A. Ross Sorkin, “Ex-corporate lawyer’s idea: Rein in ‘sociopaths’ in the boardroom,” New York Times, July 29, 2019.

3. J. Gamble, “The most important problem in the world,” Medium, March 13, 2019.

4. M. Benioff, “We need a new capitalism,” New York Times, October 14, 2019.

5. J. Stiglitz, “Progressive capitalism is not an oxymoron,” New York Times, April 19, 2019.

6. J. Benjamin, “Business class: The bankrupt ideology of business school,” The New Republic, May 14, 2018.

7. S. Long, “The financialization of the American elite,” American Affairs (Fall 2019).

8. D. McDonald, “When you get that wealthy, you start to buy your own bullshit: The miseducation of Sheryl Sandberg,” Vanity Fair, November 27, 2018.

9. M. Parker, “Why we should bulldoze the business school,” The Guardian, April 27, 2018.

10. C. Doherty, J. Kiley, and B. Johnson, The partisan divide on political values grows even wider (Washington, DC: Pew Research Center, 2017).

11. B. Lillian, “DOE report confirms wind energy costs at all-time lows,” North American Windpower, August 15, 2019.

12. G. Kavlak, J. McNerney, and J. Trancik, “Evaluating the causes of cost reduction in photovoltaic modules,” Energy Policy 123 (2018): 700–710.

13. Center for Climate and Energy Solutions, Renewable energy, 2018, https://www.c2es.org/content/renewable-energy.

14. J. Hootkin and T. Meck, Call to action in the age of Trump (New York: Business Strategy Group, 2018).

15. “The MBA Oath,” http://mbaoath.org.

16. A. Hoffman, “Management as a calling,” Stanford Social Innovation Review, September 4, 2018.

17. Gamble, “Most important problem in the world.”

18. N. Maxwell, From knowledge to wisdom: A revolution for science and the humanities (London, UK: Pentire Press, 2007).

19. R. Ackoff, “From data to wisdom.” Journal of Applied Systems Analysis 16, no. 1 (1989): 3–9.

20. N. Leiber, “Business students are putting planet over profits,” Bloomberg, November 4, 2019.

21. Yale University/WBCSD, Rising leaders on environmental sustainability and climate change: A global survey of business students (New Haven, CT: Yale University Center for Business and the Environment, 2015).

22. Net Impact, Business as unusual: The social and environmental impact guide to graduate programs—For students by students (San Francisco: Net Impact, 2014).

23. A. Jack, “The rise of the ‘sustainable’ MBA,” Financial Times, January 21, 2020; Jonathan Moules, “MBA students seek higher ‘purpose’ than mere money,” Financial Times, October 20, 2019.

24. A. Hoffman, “The evolving focus of business sustainability education,” in State of the world. Earth ed: Rethinking education on a changing planet (Washington, DC: Island Press, 2017): 279–288.

25. Benjamin, “Business class.”

26. Quoted in S. Murray, “MBA teaching urged to move away from focus on shareholder primacy model,” Financial Times, July 7, 2013.

27. W. Deresiewicz, Excellent sheep: The miseducation of the American elite and the way to a meaningful life (New York: Free Press, 2014).

28. Allbusinessschools.com, MBA salary: What you can earn, 2019, https://www.allbusinessschools.com/mba/salary.

29. B. Tuttle, “Here’s how much you’ll make at McKinsey, Bain and BCG in the U.S.,” efinancialcareers.com, August 13, 2019.

30. S. Nasiripour, “Top U.S. B-school students pile on debt to earn MBAs,” Bloomberg, June 17, 2019.

31. M. Travers, “The student debt crisis is crushing entrepreneurship,” Forbes, October 17, 2019.

32. A. Hoffman, Finding purpose: Environmental stewardship as a personal calling (Leeds, UK: Greenleaf, 2016).

33. Parker, “Why we should bulldoze the business school.”