IN THE TWENTIETH CENTURY, Asian countries—including Japan, South Korea, and Taiwan/Chinese Taipei—succeeded in maintaining economic growth while protecting domestic firms and nurturing new industrial sectors. The Asian developmental “miracle” was so named because rapid, high growth distributed wealth across classes while improving the education and skills of the domestic workforce. In the past, the ability of East Asian countries to develop economies that produced science and technology innovations on par with the West had been attributed to protectionist economic policies and investments into establishing internationally competitive national innovation systems (NIS). For example, scholars often cited such arguments as the developmental state thesis (Johnson 1982; 1995) when referring to Japan. Japan was also said to be technonational in that it equated national security with technology independence. In doing so, it prioritized protecting and nurturing nascent domestic industries while excluding foreign capital and foreign firms from the domestic market. These theories are reviewed in Chapter 2.

In a transnational twenty-first century, when countries must adhere to multinational arbiters of openness, including the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) under the World Trade Organization (WTO), states have limited maneuverability in pursuing such trade and investment protectionism as preferential treatment of domestic firms and capital vis-à-vis foreign (Lall 2004). Instead, firms must compete within a context of unprecedented international interdependence and economic openness. At the same time, states continue to intervene in their own markets to protect domestic firms and increase national competitiveness.

Country-level economic openness has been defined as the structural orientation of the domestic economy to imports and to inward foreign direct investment (FDI). Multilateral organizations, including the Organisation for Economic Co-operation and Development (OECD) and the World Bank, track openness with various composite indices (OECD 2017; World Bank 2017).1 The framing here is extended to include the mind-set of domestic political and economic leaders toward these inflows, as well as receptivity to the presence of foreigners (as expats, diaspora returnees, and immigrants). Measures of economic openness are discussed in detail in Chapter 2.

This book proposes a new framework of “networked technonationalism” to explain how states including China and India have adopted a quasi-open, yet fundamentally technonationalist stance in pursuing developmental goals. These countries benefit from harnessing global diaspora networks in making technology investments and entrepreneurial gains in the domestic economy. Outlined in detail below and specified in Chapter 2, it is this networked technonationalism that explains the relative success in certain countries in advancing the dual goals of improving innovation capacity and making gains in entrepreneurial activity in certain technologies. Old-style technonationalism, such as that lingering in Japan, is no longer tenable in the current international context. Neither is a fully open, global orientation fully viable, as the experience of Singapore shows.

In the twentieth century, technonational development was pursued aggressively by such countries as Japan. Some have argued that states should transition their economies into liberal, open markets with a global orientation (Corning 2016; Nelson and Ostry 1995). Yet, despite globalization, technonationalism is alive and thriving in Asia. Nonetheless, in order to survive and prosper in a global era within which reciprocal market openness is demanded, technonationalism has adapted and become networked. A new networked technonationalism (NTN) has evolved in places like China and India, with Singapore adopting a forced-by-circumstance technoglobal approach (Hobday 1995; Kaplinsky and Messner 2008; Nelson 2004). In NTN, industries are targeted as strategic components of the national interest and supported by government policy accordingly. These countries are also pursuing strategies to increase innovation capacity while promoting entrepreneurship in frontier industries. While technonationalism has been researched in depth in the Asian context, further comparative research may identify variations in other regions of the world.

In the twenty-first century, the international context has shifted in two key ways. First, competing at the technology frontier, countries can no longer depend on a clear path to guide them, as they had previously in catching up to Western technology levels.2 The present path to technology leadership is unclear. Second, within the current international system, demands for reciprocity mean that closing borders to foreign trade is untenable. Governance structures under a WTO regime and global production networks require a degree of openness to imports and foreign capital. This book focuses on strategies employed by governments to protect firms and workers, enhance technology gains, and stimulate the creation of new products and firms—with the aim of creating systems suited for innovation and entrepreneurship at the technology frontier.

Janus is the Roman god of beginnings, openings, and doors. Open to the outside, closed and protective to the inside, the Temple of Janus was open only during times of war.3 Likewise, Asian countries seeking to improve their innovative and entrepreneurial potential have been compelled to open to the outside world, despite the risks to the domestic economy. Today we are witnessing the retreat of the classic form of the developmental state; countries are no longer able to close their economies to foreign firms and capital in their pursuit of developmental goals (C. Wong 2012). Still, fully opening the doors to an influx of foreign investment and products may displace less competitive domestic firms and workers. This dilemma—open and exposed or closed and left behind—presents a challenge to national governments and is the central problématique of this book.

The world is witnessing an unprecedented shift of production capacity to Asia, led by economic transformation in such countries as China and India (Altenburg, Schmitz, and Stamm 2008). In 2014, Asia represented 60 percent of the world’s population. By 2050, it is anticipated that half of global gross domestic product (GDP) will be generated in that region. At the same time, the nature of international economic competition in the twenty-first century has made prior developmental strategies in Asia, including previous forms of technonationalism (TN), obsolete (Nelson and Ostry 1995; Samuels 1994). In technonationalism, predicated on the idea that technology independence is key to national security, governments target specific industries for development. Targeted industries benefit from state subsidies and protection from foreign competition. Domestic firms operating within state borders receive exclusive support within and protection from the outside.

The NTN framework extends national innovation systems (NIS) approaches beyond the territorial borders of the state, incorporating the role of international networks (Humphrey and Schmitz 2002; Saxenian 2006). An NIS is comprised of institutions, policies, and practices and the interactions among them that produce innovations in an economy. NIS is defined and explained in detail in Chapter 2. Innovation systems have the potential to extend beyond national borders. For example, high-technology clusters within economies have been noted for their high levels of international network connectivity and the access to technology expertise and venture capital that these networks provide, thus compensating for weakness in such domestic institutions as capital markets (Hobday 1995). In this new form of technonationalism, the developmental state has been eclipsed by a networked technonational state, aiming to improve both innovation and entrepreneurial competitiveness in targeted, usually high-technology industries.

Networked technonationalism is Janus-faced. It is globally oriented on the one hand, for example, via opening to inward FDI and internationalizing its workforce (e.g., expatriate and diaspora professional networks, and domestic workers learning to compete while employed at foreign firms). On the other hand, it is nationalistic, as the players engage in technology upgrading through imitation, reverse engineering, and sometimes outright appropriation of foreign intellectual property. Further, NTN countries utilize their global diaspora networks4 in a nationalist way by, for example, appealing to their national identity or beckoning them home to their families, real and imagined (Anderson 1983; Pruthi 2014). Other countries lacking a critical mass of global diaspora talent, though they may also be internationally connected (e.g., via research and development, R&D collaborations, or supply chains), are at a competitive disadvantage. Chapter 2 proposes a “knowledge and network” typology (KNT) for measuring the degree of NTN in an economy. This allows a standard method of measuring and comparing variations in the governance regime and structural and institutional architecture accordingly. The cases of China, India, Japan, and Singapore—representing variations in the degree of NTN—are examined empirically in terms of variation along a spectrum (classic technonational–networked technonational–technoglobal) and the historical-institutional context from which these variations emerged.

These countries were selected for comparative study based on their differences in market size and economic development. Taken together, they reflect broad variation on the model of networked technonationalism. To be sure, the findings would be more comprehensive if additional (Asian) countries were included. Other countries should be considered for subsequent analysis, especially as a way to examine, for example, the more narrow variation of technonationalism within East Asian countries. In this regard, Korea and Taiwan have been the subject of book-length analysis by Joseph Wong in Betting on Biotech (2011). Details on how this study builds on the aforementioned and related works are provided in the review of existing literature in Chapter 2.

In a globalized economy, countries seek international market access but prefer to protect existing domestic firms and (sometimes) nascent entrepreneurs. National governments must therefore engage in a delicate, Janus-like balance between opening their doors to foreign firms, while still supporting nascent technology sectors and enterprises. In this regard, a number of countries in Asia have targeted the lucrative biomedical industry as a potential source of competitive advantage (Bagchi-Sen, Smith, and Hall 2004; J. Wong 2005; C. Wong 2012; Koh and Wong 2005; Atkinson et al. 2012; Rasmussen 2004; Heller and Eisenberg 1998; Giesecke 2000; McMillan, Narin, and Deeds 2000; Nightingale and Martin 2004; Su and Hung 2009; Dodgson et al. 2008; Lee, Tee, and Kim 2009).

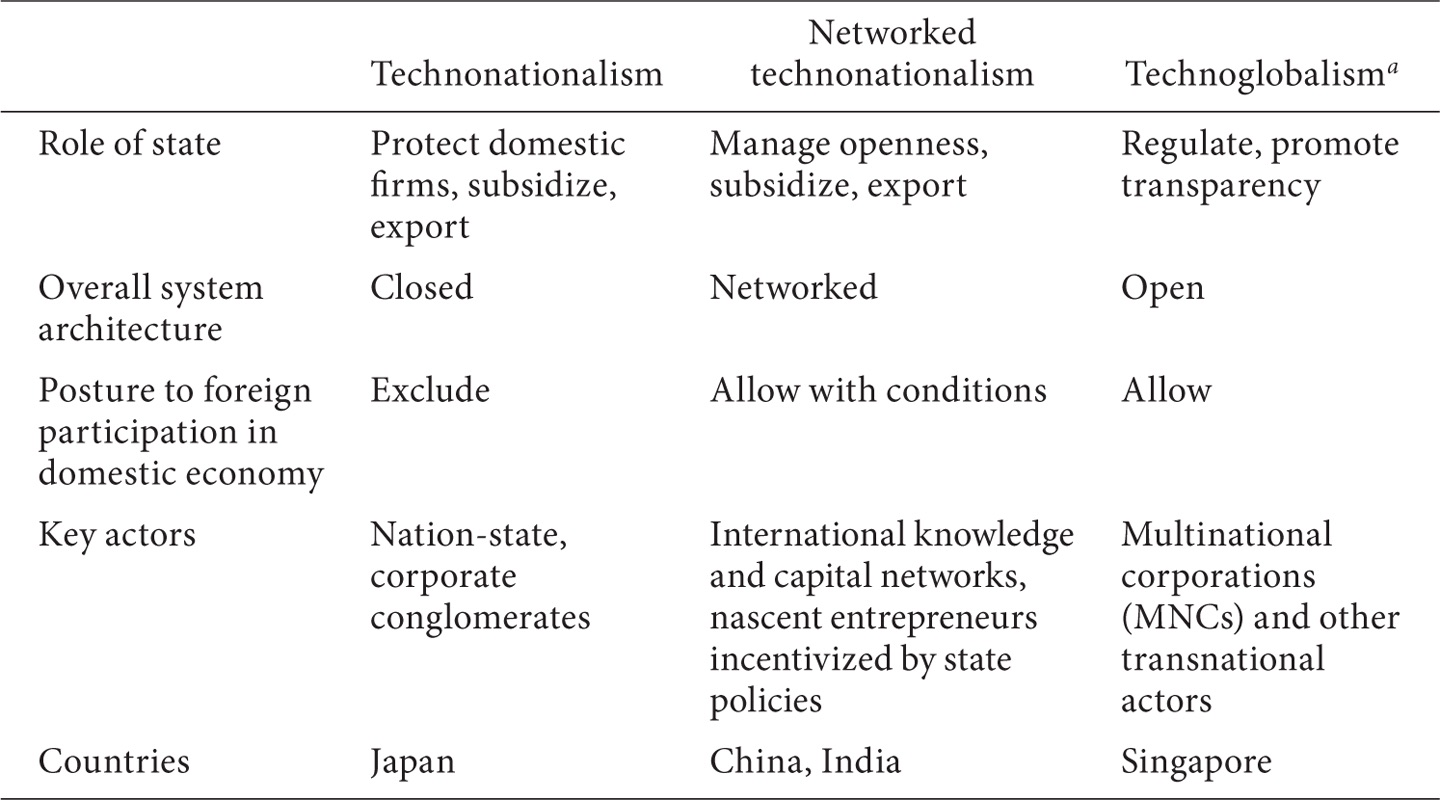

TABLE 1.1.

Technonationalism, networked techonationalism, and technoglobalism compared

This book builds on previous work in four ways. First, referencing existing literature in innovation systems and developmental state policy, it identifies links between a set of institutional practices within innovation systems and entrepreneurial ecosystems while illustrating (Schumpeterian) dynamics of innovation to entrepreneurial transformation.5 Is the technological rise of Asian countries predicated on similar domestic policies and institutional arrangements?

Second, it compares these dynamics in a number of countries representing a range of approaches: classic technonational, CTN (Japan); networked technonational, NTN (China, India); and technoglobal, TG (Singapore). Table 1.1 outlines these variations.

Third, this book addresses the global geopolitical context. The twenty-first-century global economic and political environment differs from earlier periods in that it is the most transnational due to advances in communications and other technologies, which enhances the power of transnational actors including multinational corporations (MNCs). Countries at different levels of economic development base growth policies on initial factor endowments, including the natural resources and domestic human capital at hand (Porter 1990).6 Thus, governments must be mindful of domestic and international complementarities and how to parlay them into competitive advantage.

Fourth, the book’s focus is on comparative growth and development in the global biomedical industry. The biomedical industry, comprised primarily of biopharmaceuticals and medical devices, has been targeted for innovation and entrepreneurship development by all four countries in this study, in earnest by each since the 1990s.7 Seeking to lead global markets in these technologies, the countries analyzed herein have taken divergent paths, representing a range in CTN-NTN-TG as measured by the knowledge and network typology (KNT). Further, advances in biomedical innovation and new-product and new-business creation have profound impacts on human health. Existing research on innovation and entrepreneurial systems, reviewed in Chapter 2, has been focused on such industries as automobiles, electronics, and information technology (Anchordoguy 1989; D’Costa 2012; Giesecke 2000; Mazzucato 2015, 2016; Saxenian 2006). The biomedical industry has been more dependent than others on public investments, meriting comparisons across national contexts (McMillan, Narin, and Deeds 2000; J. Wong 2011). Further, R&D alliances play a unique role in biopharmaceuticals, transcending national boundaries toward the development of a global innovation system in these technologies (Rasmussen 2004). How national governments maintain domestic investments within a globally interdependent value chain might yield useful policy insights. In this regard, this book contributes to existing literature on the role of the state in building innovation capacity and stimulating economic development.

Global Overview: Competition, Innovation, and the Biomedical Industry

This book analyzes innovation and entrepreneurship in China, India, Japan, and Singapore in the biomedical industry to present a range of approaches in technonational regime governance and institutional architecture. A focus on science and technology policy since the 1990s provides an opportunity to examine government interventions that occurred over the same period in these countries, since all included the biomedical industry, in particular, as a strategic policy target for development. Investigating state interventions across these four economies provides insights that comparison of like economies would not yield. Though China is less developed than Japan, it has challenged Japan’s performance in stimulating high-technology entrepreneurship. While Japan is a mature economy, China midstage, and India at an earlier stage, they each have attempted similar strategies regarding the biomedical industry—to varying degrees of success in striking the right notes in networked technonationalism, as the country case-study chapters that follow illuminate. Lastly, Singapore’s city-state size allowed it to pursue national, cluster, and firm-level strategies simultaneously and is worthy of comparative analysis. These Asian countries also reflect global trends in the prevalence of state intervention when attempting biomedical industry development.

Global healthcare spending is expected to continue to increase an average of 5 percent per year through 2018, remaining above 10 percent of GDP. The overall global market size for healthcare in 2014 was $9.59 trillion (Price Waterhouse Coopers 2015). In 2014, global revenue for biomedicine, also referred to as the “life-science industry,” was nearly $2 trillion. In 2014, pharmaceuticals led revenues with $1.23 trillion; medical technology (e.g., medical devices) came in at $363.8 billion (2013 data); and biotechnology, $288.7 billion (Deloitte 2015). The average year-on-year global market growth was 10.8 percent. Pharmaceuticals alone doubled from $932 billion in 2009 to an estimated $1.6 trillion in 2018.

To date, most revenue is generated in the United States and Europe, together comprising 60 percent of global revenues, followed by Asia with 26 percent (Deloitte 2015).8 The most rapid growth in the future is expected to be in Asia and the Middle East, matching the expected expansion in private and public healthcare in those regions (EIU 2014). Leading exporters continue to be the United States and Europe, while rising market opportunities include Brazil, China, India, and other emerging markets. Between 1995 and 2010, the United States, Japan, and Europe maintained their lead in global pharmaceutical industry output but declined in their total shares. In comparison, China’s total share rose from zero prior to 1995 to more than 18 percent by 2010. India’s output rose slightly to 2.4 percent by 2016 (Atkinson et al. 2012; IBEF 2016). Global demand remains strong and growing for biomedical products, indicating increasing returns for investment in biomedical industry development (EIU 2014). Consequently, strong future estimated growth in biomedicine presents significant economic opportunities for entrepreneurs, existing firms, and countries alike.

Intellectual property rights (IPR) via patent protection of products resulting from research-and-development investments have acted as a barrier to entry, enabling leading firms in the biomedical industry to garner some of the highest profit margins in the world. For example, an analysis by the McKinsey Quarterly of seven thousand public firms listed in the United States found that pharmaceuticals and biotechnology had the highest consistent returns on invested capital (ROIC), above all other industries (Jiang and Koller 2006). As such, the biomedical industry has become an irresistible growth target for governments around the world.

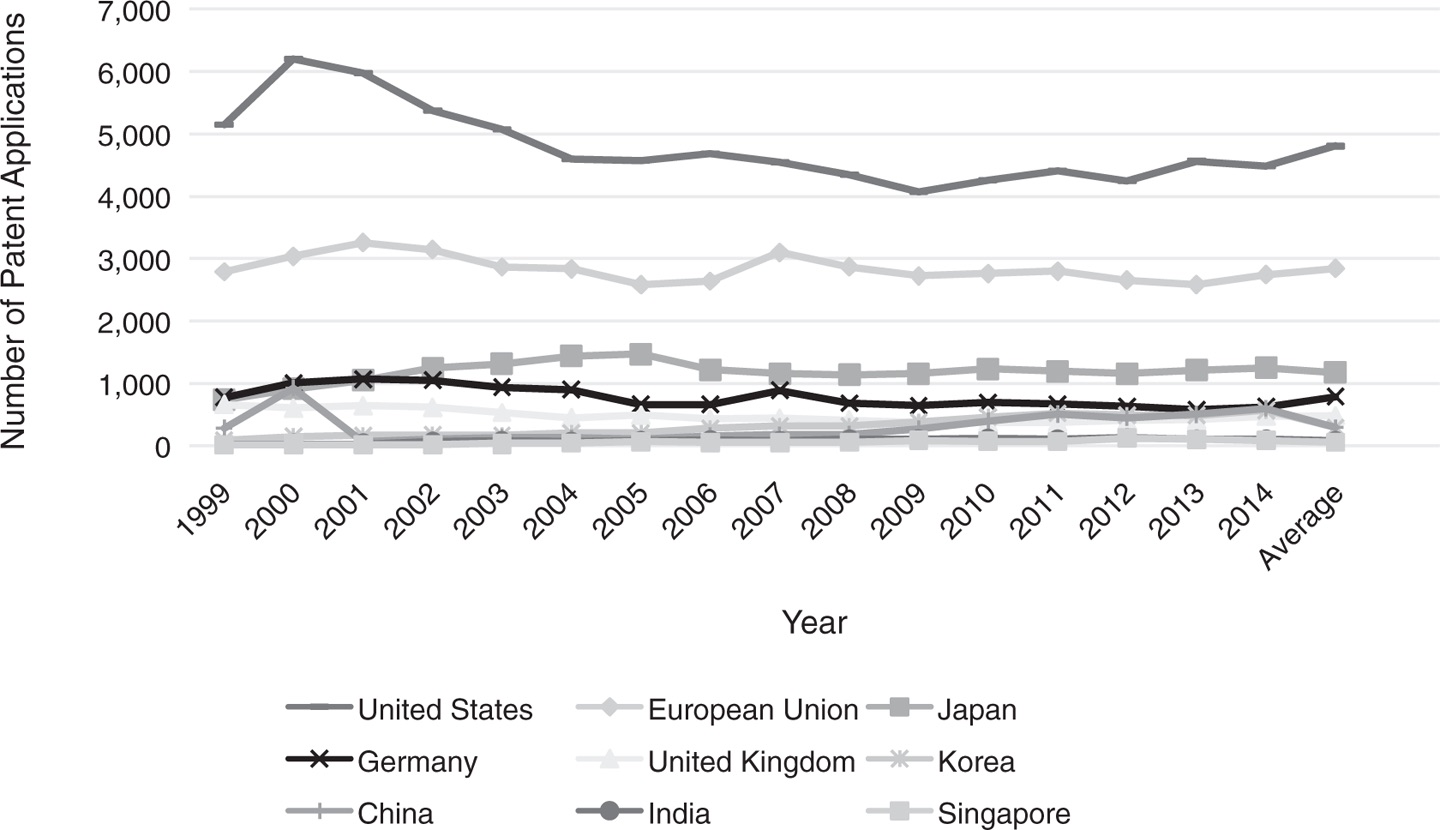

The United States has led the world in biomedical innovation, with 37.2 percent of all biotechnology patents under the Patent Cooperation Treaty (PCT),9 greater than the European Union (28.1 percent) and Japan (11.9 percent) (2010–2013 data). China’s share was 3.5 percent; India’s, 1 percent; and Singapore, 0.8 percent (OECD 2016b) (fig. 1.1). In terms of the number of firms and firm size, the United States remains the industry leader with 11,554 dedicated biotechnology firms. Japan is the only Asian country included in the analysis, with 552. Denmark, the global leader per capita had 134 firms (OECD 2016a, 2016b). Other estimates including pharmaceutical and biotechnology firms (2015 data) place China in first position in Asia with 7,500 firms. India followed with 3,000 firms (in pharmaceuticals alone), while Japan had 1,000 in aggregate. Singapore had 95 firms. As mentioned previously, other Asian countries, including Taiwan (850 firms) and South Korea (600 firms), have also targeted the biomedical industry for development, making for useful comparisons to the countries herein (Philippidis 2016; J. Wong 2011).

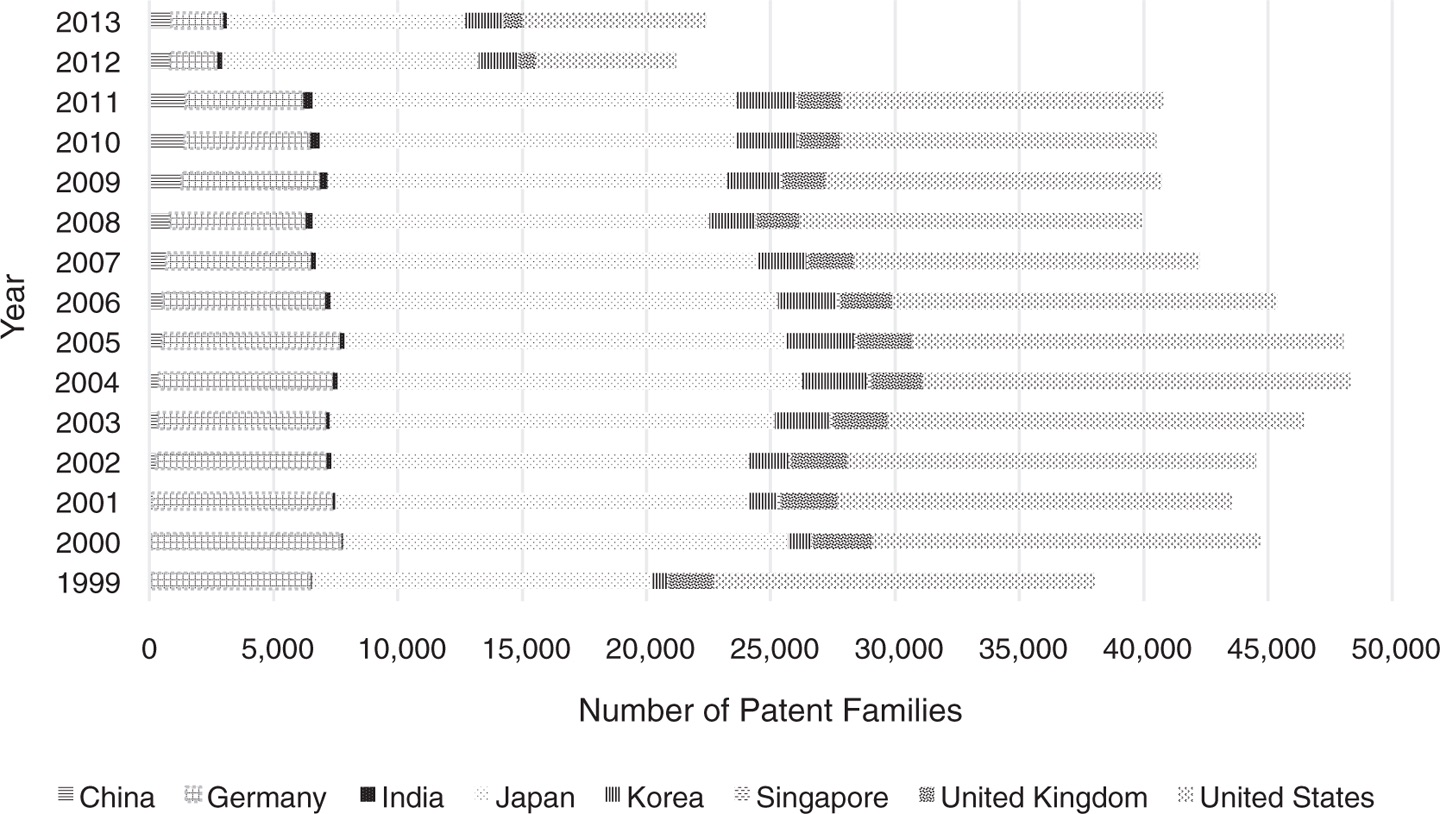

Measured in terms of bio intellectual property stock (“revealed technology advantage”) as compiled by the OECD, Singapore leads in Asia (3.3), followed by India and Malaysia (1.4). China, Hong Kong, and Korea (0.6) surpassed Japan and Taiwan/Chinese Taipei (0.4). Worldwide, Chile (4.4), Estonia (3.3.), and Denmark (3.2) take the top three slots. The United States (2.0) is twelfth in this ranking (2010–2013 data). For Japan, its absolute score declined since the previous ten-year benchmark (2000–2002) (OECD 2016a).10 Japan’s performance improves with triadic patents reported in 2013 (comprised of the European Union, United States, and Japan), for example, exceeding the number of U.S. triadic patents (17,213) with 18,702. China followed Japan, rising from a mere 63 triadic patents in 1999 to 1,473. Limiting the data to biotechnology, the United States leads, averaging 4,800 between 1999 and 2004, followed by the European Union, with an average of 2,800. Likewise, Japan leads again in Asia, producing at least 1,000 biotechnology patent applications annually since 2000. Patent Cooperation Treaty (PCT) patents represent reciprocity across 152 member countries. Triadic patents as a proxy for innovation capacity are considered a more reliable measure than comparing individual country data since the substantial time and financial resources required for multiple international filings is indicative of the perceived economic value of such innovations by the investors behind them (Warner 2015; WIPO 2016). Figures 1.1 and 1.2 illustrate these trends. Overall, Asia doubled its share of world Patent Cooperation Treaty (PCT) applications between 2005 and 2015 to reach 47 percent of total world applications. Japan led with more than 45,000 filings, followed by China with nearly 43,000 (WIPO 2016, data estimates).11

Countries seek to increase their innovation capacity through investments into science and technology research and development. R&D expenditure has remained stable across countries, with Japan and Korea spending a greater percentage of GDP than others. Between 2002 and 2012, Japan spent between 3 and 3.5 percent of GDP on domestic R&D, while the United States spent about 2.5 percent during the same period. China’s expenditure as a percentage of GDP doubled (from 1 to 2 percent), while for the years for which data was available for India, it remained below 0.75 percent. Most countries increased the number of R&D personnel in the 1990s and 2000s. Japan remained about the same, while Korea made the most gains among Asian countries, resulting from its commitment to technology capacity improvement (C. Wong 2012). China made significant progress after 2005, doubling its per thousand of labor force in R&D (from 2 to 4 percent) (OECD n.d.a). Figures 1.3 and 1.4 illustrate these trends in global context.

If all goes as planned, government investments in R&D and human capital result in innovation capability improvements. These are certainly necessary conditions for innovation-system development. However, as the analysis herein demonstrates, a national government that mitigates openness in a globalized economy while pursuing not just developmental, but innovation and entrepreneurial goals may provide the sufficient conditions for leapfrogging over international competitors. As a point of departure, key concepts in the analysis of technonationalism in innovation and entrepreneurship are introduced below and contextualized within existing literature in Chapter 2.

1. In theory, a completely closed economy would not have any imports or exports, and the less open to the outside, the greater control state leaders have over capital and labor within the domestic economy.

2. In the twentieth century, according to Rostow (1960), advanced industrialized countries in a “flying geese” pattern of development served as lead goose in advancing through the stages of development within industries in less developed countries (LDCs) toward higher levels. In this pattern, LDCs would start at low levels (e.g., component manufacturing) of the global value chain in a given product, learning by doing and eventually catching up to the lead goose in a particular technology.

3. I have chosen to use the Roman god Janus as a point of reference as it is likely to be familiar to Western readers. In Asia, the paradox of open-exposed / closed-protective imagery (for example, in Buddhist temple guardian lion-dogs) predates Janus by more than half a millennium.

4. The role of international networks is discussed in detail in Chapter 2. See Freeman (1991) for an overview of innovation networks and Coviello and Munro (1995) for reviews of the internationalization of entrepreneurial firms.

5. Joseph Schumpeter (1942) coined the term creative destruction to describe the transformation within economies from mature and declining sectors to new and emerging in which the role of entrepreneurs is paramount.

6. In contrast to earlier periods in which rapid home-country economic development occurred via colonization in politically suppressed and economically exploited host country colonies, national governments have since been constrained in their access to outside resources (Chang 2002; D’Costa 2012).

7. For example, as discussed in Chapter 5, from the 1930s, India had invested in generic pharmaceuticals, but until the late 1990s, it relied on technology importing.

8. In the Deloitte study, the life-science industry was comprised of biotechnology, pharmaceuticals, and medical technology segments.

9. Patents filed under the PCT, administered by the World Intellectual Property Organization (WIPO), allow applicants to have intellectual property protections across a large number of countries simultaneously. As of 2017, there were 152 PCT member countries (WIPO n.d.).

10. The OECD revealed technological advantage index is determined by the share of country (or economy) in biotechnology patents relative to the share of total patents in that country (or economy). OECD statistics include countries with greater than five hundred biotechnology patents (OECD 2014).

11. Overall competitiveness in these economies mirrors the global trends outlined above in the biomedical industry. The World Economic Forum, known for its annual convening in Davos, Switzerland, of the economic literati and moneyed, publishes the Global Competitiveness Report. Its rankings of 144 world economies are based on a composite of twelve measures, including institutional capacity, technological readiness education and training, and overall macroeconomic environment. The 2014–2015 edition places Switzerland at the top, followed by Singapore, the United States, Finland, and Germany. The top three in Asia are Singapore, Japan, and Hong Kong SAR. China places eleventh in Asia with a global rank of twenty-eighth, while India ranks seventy-first (Sala-i-Martin et al. 2014). The 2017–2018 edition places Switzerland in first place, followed by the United States, and Singapore in third place. Furthermore, Japan is ranked in ninth place, China in twenty-seventh place, and India in fortieth place (World Economic Forum 2017a). The Global Innovation Index (GII), published jointly by Cornell University, INSEAD, and the World Intellectual Property Organization is a composite of seven indices (five input, two output). Input measures include such human capital as scientists and engineers, research, infrastructure, policy, and knowledge absorption. Knowledge, technology, and creative outputs complement input measures. The 2018 GII ranks the top ten innovation economies as follows: Switzerland, Netherlands, Sweden, United Kingdom, Singapore, United States, Finland, Denmark, Germany, and Ireland. Japan ranks thirteenth; China, seventeenth; and India, fifty-seventh. In the GII 2014 report, China was noted in the report for its significant improvements in developing institutions to support innovation. India lags due to declines in manufacturing output and a slide in input capacity (Dutta 2014, Lanvin, and Wunsch-Vincent 2018).