Together with a research chemist he had hired, George Eastman founded the Eastman Kodak Company in 1892 after a fifteen-year series of inventions and refinements that ultimately led to the ability to take a snapshot picture and develop film using a novel rolling technique. The inventions included dry plate photography; the equipment to produce such plates; “negative” paper; transparent, flexible roll film; and the camera that would enable its use.1 Kodak became an icon among large industrial companies, providing the mass market access to the hobby of photography through its development and commercialization of the pocket camera. Subsequent business platforms were based on Kodak’s later inventions of motion picture film, color film, and film that enabled “talkie” movies.

As late as 1976, Kodak commanded 90 percent of film sales and 85 percent of camera sales in the United States.2 By 1988 Kodak employed more than 145,000 workers worldwide.3 By its peak year, 1996, Kodak held more than two-thirds of global market share in film and cameras and was worth more than $31 billion. The Kodak brand was the fifth most valuable in the world.4

In January 2012, just fifteen years later, Kodak declared bankruptcy. Its global workforce had shrunk from its 1988 height to thirteen thousand.5 Ironically Kodak is recognized as holding the patents that claim the invention of the digital camera. Yet not only did this great company fail to commercialize the digital camera first; it resisted embracing the business opportunity even as digital technology was licensed from it and came to market through others.

Kodak is not unique in its near-death experience associated with refusing to engage in the new technological order. Nortel Networks hid its head in the sand in June 2009 as its core business was shattered by the advent of Internet-based communications.6 There are countless examples of companies that flourished on the basis of successful introductions along predicted technology trajectories but that simply could not arrange themselves to accommodate major technological or market changes, much less lead them. Even more frustrating, many of those same companies harbor advanced technologies that could bring immense value to the marketplace; however, they lack the expertise to innovate beyond their core products. Many potential breakthroughs are left sitting on the shelves in R&D labs, collecting dust.

It is not that Nortel didn’t see it coming, and the same can be said for Kodak. In fact, both had established innovation hubs: groups or departments whose mandate was to develop breakthrough new businesses for their companies. At Kodak the group was the Systems Concept Center. At Nortel it was called the Business Ventures Group. Both were run by smart people who reported directly to their companies’ chief technology officers. Why didn’t it work? Indeed, why do we hear these failure stories over and over again?

What is the Reason?

As obvious as the problem is, explanation as to why it endures is up for debate. Several reasons have been accepted as conventional wisdom, thereby allowing leaders of large companies to shrug their shoulders and indicate there’s not much that can be done. These include the following.

Core Capabilities Become Core Rigidities.7 Most would agree that the culture of operational excellence necessary to keep customers and stockholders satisfied precludes the kind of exploration, learning, and redirecting that is natural for developing and commercializing breakthroughs. These potential new business platforms are fraught with high levels of ambiguity and risk, and so they require different processes, systems, metrics, and talent than mainstream management systems are designed to support. Mainstream cultures thrive on leveraging what they know rather than pioneering the unknown. The original breakthrough innovation that fueled so many companies’ infancy and growth becomes the barrier to their next frontier. What starts as a core capability, a company’s sustainable competitive advantage, becomes a ball and chain around its neck. Chemical film processing put the chokehold on Kodak. It was the telecommunications infrastructure at Nortel. IBM’s near-death experience in the late 1980s was due to its worldwide success in mainframe computing. Ironic, right?

Over time companies stultify innovation. Processes become more influential than people. They take on a life of their own. New product development processes are well honed in companies today, but they are designed to produce incremental innovations that serve current markets and leverage what the company knows best. They don’t produce new platforms of business born of novel technologies that require different business models. Metrics that measure progress and success are based on knowable, predictable market and financial returns. None of these exist in the world of breakthroughs, which oftentimes upend current markets completely. We have seen over and over that large established companies fail to leverage new opportunities even when they themselves create those possibilities.

Senior Leadership Incentive Structures. A second reason offered for failure to successfully experiment with path-creating change is the financial incentive system for corporate leaders and boards, especially in US-based companies.8 A recently published study of CEOs and CFOs reported that, to avoid missing their own quarterly earnings estimates, 80 percent were willing to forgo R&D spending.9 Political pundits suggest that SEC rules in the early 1980s easing stock buybacks have enabled executives to manipulate share prices through the timed release of positive news so that their incentive compensation payouts are maximized.10 Stock-based incentive compensation for executives encourages them to make decisions based on what traders and hedge funds want, which are short-term gains in stock price.11

Indeed, pressures to elevate short-term stock prices at the expense of long-term investments are so enormous that some US-based companies are moving their legal homes to other countries whose infrastructure and financial markets place greater value on long-term investments. The CEO of Mylan N.V., a drug manufacturer who moved from Pennsylvania to the Netherlands to avoid a hostile takeover, is quoted as saying, “This is a stakeholder company, not a shareholder company.”12 Recognizing an organization’s multiplicity of constituents may cause leaders to take a longer-term view, and that sounds reasonable. Yet in both the United States and in Europe, private-equity companies are buying seats on company boards to eventually take over voting rights and flip the companies for large financial gains, after stripping them of corporate-level, long-term investment capabilities.13

While these explanations are surely important influences on behavior, we’d like to offer a third that we believe bears examining and could diminish the impact of the first two. Companies need to develop bench strength for innovation. What are we doing about selection, development, and retention of innovation talent? Could companies build a talent base and infrastructure system to create “newstreams” just as well as they reinforce “mainstreams?” What if we could identify expertise in this arena and institutionalize it? Would companies improve their capability for commercializing innovation? Would the financial markets recognize this investment?

We believe the answer is a clear yes. Management theory and practice has become increasingly sophisticated over recent history. We’re expert in marketing, finance, and in information systems management. We have cracked the code on manufacturing systems management, on quality management, and we are attacking data analytics now. It’s time to step up and become expert on innovation . . . the kind that brings new orders of magnitude of value to the marketplace and therefore to the company. We’ve been researching this phenomenon, which we’ve labeled “breakthrough innovation,” for decades now and have learned a lot. It is time to put it to practice. To do so will require new thinking about innovation talent management.

Our research shows that, in large part, companies have shot themselves in the foot when it comes to building a sustained capability for breakthrough innovation. They’ve not taken as strategic an approach as is necessary to develop innovation capability. A large part of that problem has to do with how companies manage one of their most precious assets: human capital. In Kodak, Nortel, and many other companies, the roles and responsibilities required for a successful breakthrough innovation capability were not clarified, described, or institutionalized. People volunteered. There were no tools, frameworks, or attention given to recruiting, selecting, and developing innovation talent. People cycled in and out of innovation hubs that had cool names but no staying power. In a number of the companies we researched, innovation hubs existed but were populated with part-timers or people cycling through for short-term professional-development experiences. The “other part” of their jobs required attention to near-term, immediate issues focused on current customers, current operations, and the consequences of those issues on the next quarter’s stock performance. In some cases the groups we studied were filled with inventive, creative types, but they lacked personnel to incubate, experiment, and grow the businesses that resulted from the creative genius of their “think tank” partners.

In all these cases, and for any one of these reasons, the innovation hubs did not have the opportunity to develop expertise they could leverage over and over again. They could not practice, improve, and become increasingly sophisticated at what they did. Of the companies we studied, talent management practices for people who filled innovation roles were lacking. Selection, development, and retention approaches for innovation personnel were overlooked, undervalued, and/or misunderstood.

The people who work on the breakthrough innovation efforts are considered off the beaten path. For any ambitious employee looking to become a person of influence in the company, time spent in an innovation role is considered a “time-out” in his or her career. In fact, participants were viewed as misfits in the organization. There was no career path for people who prefer to work on developing potential breakthrough new businesses other than a higher potential of being released during lean times or when the flavor of the day was something other than innovation. The average life span of a new ventures group in large companies is just a little more than four years,14 and the personnel affiliated with breakthrough innovation projects and hubs are not always treated well when the dissolutions occur.15

Conventional wisdom holds that breakthroughs occur when highly driven project champions, shielded from company rules and policies by a senior leader sponsor, are allowed the freedom to break conventional practices and do what needs to be done. Some companies call them mavericks. Some call them hero-scientists, and others call them intrapreneurs. Once in a while this approach works, but more often they are the outliers. In most cases, in the stories you never hear about, the champion model fails. The disgruntled intrapreneurs leave the organization or remain and burden themselves and their organizations with cynical attitudes or deflated spirits. Even in those instances when it works, intrapreneurs contribute to company folklore but may not be willing or able to help the company develop a sustained innovation competency.

Returning to the Kodak story, the employee who invented the digital camera, Steven Sasson, was clearly a brilliant R&D scientist and a phenomenal inventor. In fact, President Barack Obama awarded him the National Medal of Technology and Innovation in 2009. In conferring its Innovation Award on Sasson in 2009, the Economist called the digital camera a “seismic disruption” that rendered the existing technology virtually obsolete.16 And his alma mater (Rensselaer Polytechnic Institute) inducted him into their hall of fame in 2011 . . . just before Kodak declared bankruptcy. Steve Sasson was a great inventor, but he was not an intrapreneur. He did not have the championing qualities companies seem to depend on to push, prod, cajole, and nag leadership to respond to opportunities or to impending threats. He invented the digital camera in 1975 and moved on to his next project. Did he do his job well? Yes! But there were multiple other tasks and activities that needed to occur, and no one was assigned to take them up.

This book is predicated on our belief that companies cannot improve their innovation outcomes unless there are people charged with managing a system devoted to that objective. While this sounds obvious, the fact is that there are few companies today with formal, consistent roles associated with new business creation that leverage R&D investments beyond the core business. There may be projects, task teams, and passionate people who make up interesting titles for their business cards (and we’ve seen a number of them!), but few companies have a clear, enduring organizational design for commercializing new business platforms based on breakthrough discoveries, inventions, or strategic objectives. Few have clear roles articulated, personnel selection criteria delineated, or career development opportunities embedded, as is the case for virtually every other function in the company.

Through our research we have identified a number of interesting roles and responsibilities that companies experiment with. No single company has the whole picture. Our results derive from assimilating best practices, observing challenges companies and individuals face in executing innovation, and filling in the gaps. Companies can get better at breakthrough innovation and develop a capability for what we call strategic innovation. Senior leaders say they want just that. We believe this book will help speed the process.

Organizational Experiments

Since the 1970s and 1980s when this problem was first articulated, companies have experimented with a number of approaches to get breakthroughs.17 They’ve tried process-based, cultural, and structural approaches of many flavors, along with financial approaches. Some companies cycle through them all, again and again. So far none have endured or become the template for others to follow. Your company probably has remnants of each.

Process-Based Approaches. When Robert Cooper recognized and described the weaknesses in large companies’ new product development process, and prescribed a Stage-Gate® approach to improve it, he took the world by storm.18 The insight was to work in a cross-functional team, and to consider marketing, engineering, manufacturing, and cost implications as needed in pursuing a new product concept through a prescribed series of development steps. Gate reviews imposed discipline and enabled the company to make explicit decisions at specific junctures as to whether or not to continue investing. Gate reviews resulted in “go” or “kill” decisions, thus allowing decision makers to prevent losses on projects that would never succeed commercially as soon as possible. The process brought efficiency to what had previously been considered a handoff, serial process that resulted in outdated, costly products. The Stage-Gate® and other similar processes are deeply institutionalized in most large, mature industrial companies today and have dramatically improved cycle time and effectiveness of the new product development process for familiar markets and technologies.

Many managers inform us that they apply a similar approach to breakthrough innovation, because it is familiar and works within the organization’s operating norms. To allow for the higher uncertainty and risk associated with breakthrough innovation, they impose a “Loose Stage-Gate®” process. What that means is that gate criteria are allowed to slip or are relaxed: the project is allowed to proceed to the next stage even if it meets just part of the gate criteria, subject to its meeting the remaining criteria at a subsequent gate.19

Hmm . . . Well, we’re not convinced, and we have not seen it work. A completely different approach is needed for innovation that will set the future for the firm—one that is exploratory and learning oriented, rather than confirmatory and responsive to market demands. We need an approach that incorporates organizational change as part of its core activities. A breakthrough project under development does not depend on current available resources, organizational arrangements, or business models; it is open to accessing new resources and creating new organizational arrangements and business models. It does not depend on market research but rather on market creation. Prescribed project management steps will not work, since learning in one stage determines the next steps to be taken. Gate criteria, therefore, cannot be preordained. Each learning loop sets its own objectives. Gate review committees become strategic coaches rather than evaluators.

Empirical research supports our observations and company managers’ experiences. Results of a study of 120 projects that used the Stage-Gate® process showed that the application of strictly enforced and objective evaluation criteria for improved control makes projects more inflexible and leads to a failure to actually learn.20 The more novel the project, and the more turbulent the technological environment, the worse its market performance under a Stage-Gate® approach. This same research also found that loosening the gate criteria does not help and, in fact, does not impact market performance at all. Unfortunately, this approach is the most commonly adopted for managing breakthrough innovation among all the companies we investigated.

Companies are also trying entrepreneurial process approaches, such as the Lean Startup Method,21 as an alternative to the Stage-Gate® model. Developed for the software-based start-up environment, the approach prescribes the kind of field-based market learning orientation we encourage. But the Lean Startup Method is more suited to its title—start-ups—than to the corporate environment. Organizational strategy, structure, and politics are crucial issues when handling breakthrough innovation in large companies, and this method doesn’t help project managers address those concerns. It is also a process that does not align with the management system of operational excellence, and so it needs to be situated in a management culture that allows those who use it to succeed. There has to be a better way.

Culture as a Driver. Another approach to succeeding with breakthrough innovation is the culture approach. We heard several companies declare that breakthrough innovation occurs because “We have an innovative culture here.” They’re proud of it. They repeatedly state it. It’s written on the walls and on the website. Internal networks are active, people share information readily, and company rules may even dictate that every employee can spend up to 15 percent of their time each week on a project of their choice that may result in something big.

Most companies that innovate successfully this way are run by their founders. Google, Amazon, and LinkedIn all come to mind when one thinks of innovative cultures. Others, such as Hewlett-Packard, Analog Devices, Polaroid, and Apple, were innovative when run by their founders, entrepreneurs who called the shots regarding which products would come forward and which would not. Fully half of the top ten most innovative companies on Fortune’s list of the top one hundred in 2014 are run by members of their founding team.22 The founders set the culture. That’s great. But those companies are not the subject of this book. We’re concerned with mature, established companies who must find a way to innovate after the founding team has long since handed over the reins.

Of those, 3M is among the most famous for this cultural approach. “Grow and divide,” “Make a little, sell a little,” and “15 percent time devoted to innovation” are cultural norms that 3M instituted long ago, and to which it credits its patience for developing and incubating a number of new opportunities, such as the Post-it note or the optical display technology that led to privacy screens for computers. 3M’s innovation culture leads to a “let a thousand flowers bloom” outcome. It produces many innovations but not too many breakthroughs. 3M did not make the Forbes’s top one hundred most innovative companies list in 2014. Recently it has focused on adopting a lead user process,23 formed a new medical materials and technologies group to drive breakthroughs in that market arena,24 and changed CEOs four times since 2001. It’s tough to maintain a culture of innovation under those conditions.

Maintaining an innovative culture that results in breakthrough new businesses is extremely difficult for large mature companies. Lou Gerstner, past CEO of IBM and author of Who Says Elephants Can’t Dance?, notes that IBM’s culture was his greatest challenge when he was struggling to save it from the brink of bankruptcy in the mid-1990s.25 He was reflecting on Rosabeth Moss Kanter’s original observation that professional management, that is, bureaucratic management, is inherently preservation seeking, compared with entrepreneurial management, which is inherently opportunity seeking. Managers in established companies succeed by administering known routines in a uniform manner. They use past experience to guide them in establishing and refining those routines. Deviations from these routines spell failure.

In contrast, the major concern of entrepreneurial organizations is to create and exploit opportunities—however that can be done—without regard to what the organization has done in the past and without regard to resources currently under its control.26 So, while a cultural approach to sustaining capability for breakthrough innovation in large established companies is important, it cannot be depended on as the sole answer. There must be more: a management system in which it operates and expertise in innovation itself.

Structural Approaches. Recognizing that cultural norms supporting breakthrough innovation are difficult to sustain in a mainstream organization devoted to operational excellence and keeping customers satisfied, companies sometimes set up special groups committed to carrying out an innovation mandate. Some of these organizational designs, such as Skunk Works, popularized by Lockheed Martin, and off-site incubators, most notably Xerox PARC, sequester innovation groups from the mainstream. The reasoning behind that choice is to allow as much independence from the mother ship as possible so that technical resources, manufacturing systems, and revenue models can be developed completely independent from corporate’s current approaches.

Skunk Works projects tend to work when the objective is clear at the outset, senior leaders are committed to the presumed outcomes, and the organization is strategically prepared for the new business that will ultimately result. Anything short of these three criteria and Skunk Works turns into someone’s favorite project that ends up going nowhere. Off-site incubators have resulted in wonderful innovations, such as the graphical user interface (GUI) system, the mouse, and many others. However, they oftentimes end up on the commercialization docket of other companies. The link to the company’s core business or strategic intent is typically too tenuous to result in any of the benefits being transferred back and changing the mainstream organization.

New ventures groups, such as those developed and popularized by Nokia, Nortel, Lucent, and Procter & Gamble, gained favor in the late 1990s partially as a way to stem the flood of talent from these large companies to Silicon Valley. These groups are typically linked to corporate R&D and therefore have the potential to contribute to the strategic intent of the company. Most, however, have struggled with that link and have become a mechanism for diversification more so than organically grown breakthrough new business platforms, given the relatively low levels of involvement of senior leaders and the uncertain corporate commitment to the nature of the investments they are making. Nortel, for example, initiated the Business Ventures Group (BVG) in 1996, an in-house incubator whose purpose was to enable employees with creative ideas to develop them in a start-up environment within Nortel rather than defecting to Cupertino. The design included an entrepreneurial culture, a set of coaches, external and internal investors, and a governance structure that would run interference between the portfolio of small companies and the typical expectations and processes of the mainstream company. The BVG’s director was a vice president who reported directly to the CTO of the company. However, when the company changed CEOs, so, too, was its growth strategy altered. The new CEO favored acquisition over internal development and substantially reduced R&D spending. The CTO retired, and the BVG was defunded.

Ironically, Nortel could not make the change from the telecom era to the Internet era, which was the original mandate of the BVG. In 2009 Nortel declared bankruptcy and ceased operations. In October 2008, one of the BVG’s portfolio companies was acquired by EBay/PayPal for nearly one billion dollars, which was greater than the market capitalization of Nortel at the time.27

Similar stories exist with Lucent’s, Xerox’s, Motorola’s, and Nokia’s venture groups. Nokia, a tire manufacturer in Finland who had risen from the ashes to laudatory profits through its success in transforming itself to a diversified company with holdings in electronics, rubber, materials, and more, was widely regarded as one of the companies at the forefront of new venture creation capability because of the design and success of its new ventures organization,28 which is credited with developing and commercializing Wireless Application Protocol (WAP) and ultimately forming Nokia Internet Communications, which supported the move into handsets. However, Nokia couldn’t keep it going, and ultimately it sold its phone business to Microsoft, who has since laid off twenty-five thousand workers, nearly all that it had acquired from that business deal.29

Finally, organizations may initiate innovation programs, such as IBM’s Emerging Business Opportunity (EBO) program.30 Introduced in 2000 in response to a call from CEO Lou Gerstner, the EBO program was designed and managed from the Corporate Strategy Office. During the time it ran, it was a great success, initiating twenty-five new ventures and delivering close to $10 billion in new revenues within the first five years, with ongoing revenue streams for more years to come.31

As IBM defined it, an EBO focused on “white space” opportunities with the promise to become profitable, billion-dollar businesses within five to seven years. The program was based on the recognition that different growth horizons require different management systems.32 The Horizon 3 management system was designed specifically for seeding new potential business options, with the recognition that those opportunities were operating under a high degree of uncertainty and needed to be managed accordingly.

EBOs were typically assigned an experienced IBM executive leader to manage the venture during its start-up phase. An experimental, learning-based approach to project management was applied. Pilot projects, almost always involving clients, validated and refined initial ideas for the EBO’s products or services. Once an EBO grew to sufficient size, it was overseen by an existing IBM business unit. They were always incubated within one of IBM’s many business units, but they were governed by the top corporate executives.

In 2006 IBM moved away from a focus on Horizon 3 businesses and applied the principles of managing EBOs to a broader set of growth opportunities, including business process changes and expansion into emerging economies.33 At this point the EBO program is a fond memory. It is currently not referred to on the company’s website. While many of those twenty-five EBO leaders have had rewarding careers and carry that experience with them, the VP of corporate strategic planning who oversaw the management system retired.

Programs come and go. Functions do not.

Financial Incentive Approaches. We’ve seen two quite different financial incentive-based approaches that firms use to institute an innovation capability. The first, adopted by companies that plan to spin ventures out, is to issue phantom stock so that intrapreneurs share ownership in their ventures. By and large this model has evaporated, because it sets up an “us and them” mentality. If intrapreneurs can share in the equity of their businesses, why don’t all hardworking employees share directly in the financial upside of their respective projects and functions? And if the company plans to retain the venture rather than sell it, how would one value the venture in order to issue phantom stock?

Every company that we’ve studied or spoken with eventually has backed away from this approach. While intrapreneurs claim they take more risk than other employees do, their risk levels do not approach those of entrepreneurs. They still receive their regular paychecks, and they rely on company resources and capabilities. As one executive pointed out, if the company wishes to make innovation an institutionalized part of it, employees who work on innovation projects should not be granted financial favors. Key to his point is that they also should not be punished, of course (which, as we see in coming chapters, is not always the case).

A second financially driven approach firms take is to build and exploit a corporate venture capital (CVC) fund. Investments in small start-ups outside the company’s walls help the corporation understand technology trends in key areas of interest, and ultimately position the firm to acquire promising start-ups. Having made its first appearance in the mid-1960s, the CVC model has endured more than the others.34 Today more than 750 companies list CVCs in the Global Corporate Venturing database,35 and their investments cross many sectors. While this approach is a wonderful complement to internal, organic growth, it does not help the company if it functions in isolation. An innovation capability must complement the investment in externally sourced technologies.

Distinctive Management Approach Needed: An Innovation Function

Champions, Skunk Works, venture groups, and programs may all have their place, but so far none has had the kind of impact our companies require or solved the dual problem of successfully commercializing breakthrough innovations for the market and creating new growth platforms for the company from which they originated.

Our research leads us to conclude that innovation must be managed as any other typical business function, accompanied by an appropriate management system charged with the mandate to find and nurture the company’s businesses of the future. To develop the expertise needed, there must be formalized roles at multiple levels. Over time, people filling these roles will develop expertise. Companies need people with innovation skills in addition to passion. Companies will recruit for those roles, select carefully, and develop people. When a person moves on in her career, they will replace her with someone of equivalent acumen. In this manner, innovation capability will become institutionalized in companies. While new product development (that is, incremental innovation) can be managed as a process, breakthrough innovation cannot. Innovation is a function. It’s not R&D, and it’s not marketing. It is its own function.

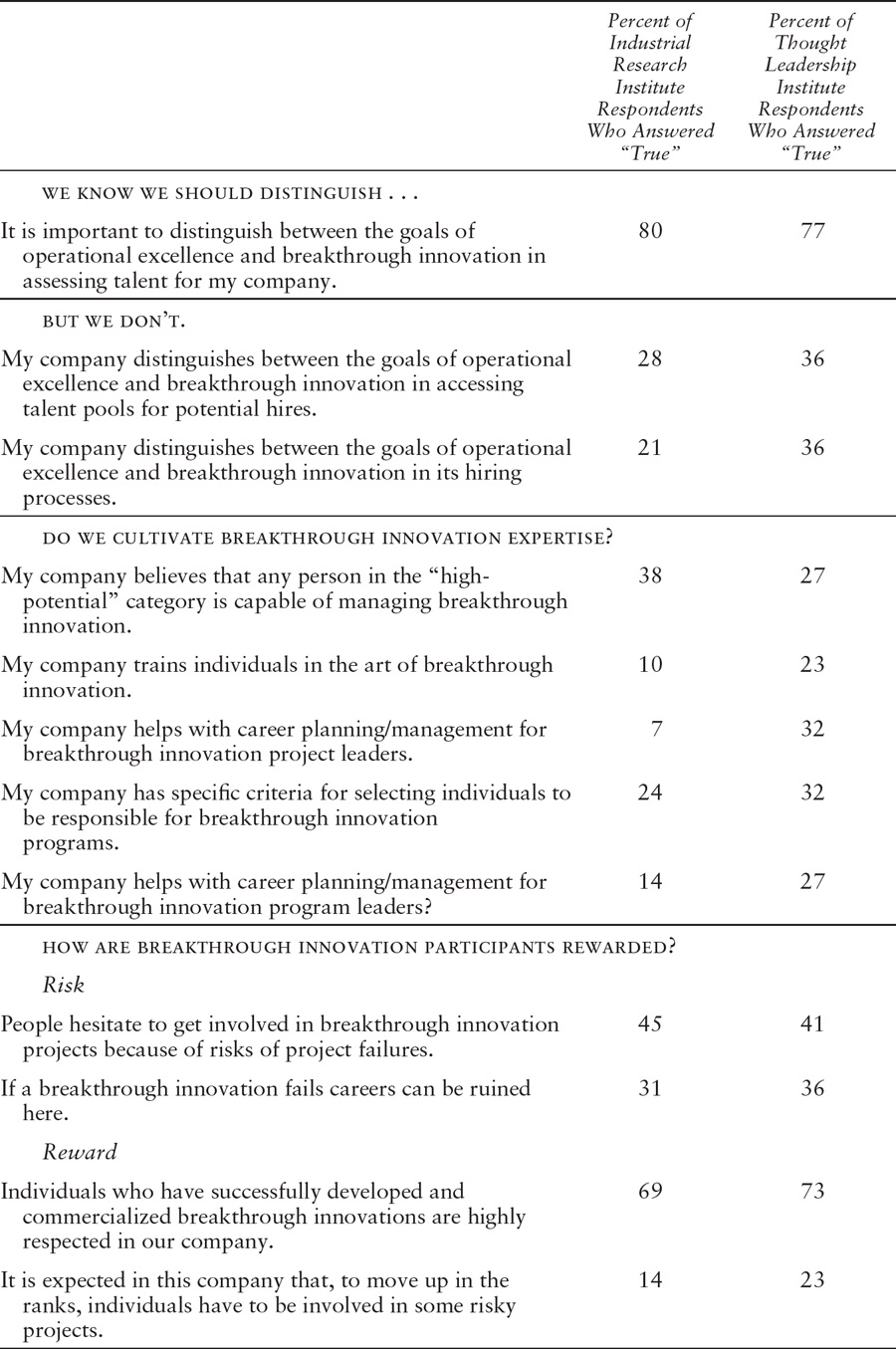

It turns out that we’re not the only ones beginning to see this option: Russ Conser, former director of the Shell GameChangers group, enthusiastically supports the notion. “We will be amateurs at Breakthrough Innovation until we get the talent management part right,” he confirmed when we interviewed him. Others share the concern. The Thought Leadership Institute (TLI), a professional organization of HR and organizational development leaders, and the Industrial Research Institute (IRI) each surveyed its members about the issue of talent management for breakthrough innovation. Although the number of responses was small (twenty-nine IRI members and twenty-two for the TLI), their responses, shown in Table 1.1, aren’t surprising and send a clear message.

The vast majority of both groups indicate they realize that the goals of operational excellence and breakthrough innovation are different enough to require distinctions in assessing talent for those roles. But on average, fewer than one-third do. And the percentage of respondents who believe they cultivate and develop innovation talent is also low . . . much lower for those from the R&D community than from the talent management community, but still low overall. Finally, the survey shows that, while it is viewed by both communities as fairly risky to one’s career to undertake breakthrough innovation, the rewards for commercial success are high. So the message that comes through is, “Go for it, but at your own expense!” Or, put another way, “We want you to do it, but we won’t give you any support; we make no promises, and you’d better not fail” (even though breakthrough innovation is fraught with false starts, stops, pivots, and all the things that look like failure in an operational excellence world). Not a great message for companies who pride themselves on competing via innovation.

Why do companies send this message? We believe it is because they don’t know what to do. But in fact, much more is known today about management practices for breakthrough innovation than even five years ago. It’s time to become as sophisticated about innovation as we are about marketing, finance, information systems management, quality management, operations, and R&D.

This is the next opportunity for a major step forward in management practice. We can get it right. By doing so, we help companies, the marketplace, and society benefit from those dusty inventions sitting on shelves that should be changing the game.

The Talent Management Gap and Its Link to Strategic Innovation

Our premise is that the concept of breakthrough innovation is evolving. With a clearer understanding of how it actually occurs, we can now build management systems that support its unique characteristics of uncertainty and ambiguity, and we can become more proactive at addressing those uncertainties. It becomes more strategic and less opportunistic. We know now how to hunt for and recognize emerging disruptive technologies. We know more about open innovation strategies and partnership arrangements for accessing resources and competencies without full-force investment before we’re more certain.

Talent management for innovation must be addressed for companies to develop expertise that survives a single successful champion. This is an overlooked aspect of a management system for breakthrough innovation. This is not rocket science, and you may believe your company handles it well. Following are true accounts from people who work in the well-known companies we studied. We call them our “pain stories”: good, smart people who were penalized for their engagement with breakthrough innovation, or who were expected to succeed in aspects of the innovation process far different from the expertise they brought to the table.

The R&D champion who spotted an opportunity to apply a discovery in avionics to medical-imaging technology in one of our companies was responsible for bringing it to the attention of the vice president for research. It was a breakthrough concept if applied appropriately in the medical field. However, the president of the medical-imaging business unit at the time wanted no part of it, indicating that the business unit did not have the manufacturing capacity to handle this new technological approach, nor did they need the business given their growth rates with the current technology. Why fiddle with a successful product platform? The champion continued to press, and the business unit finally sought an external manufacturing partner, having perceived a threat when it heard that a competitor was experimenting with a similar technology. The manufacturing partnership failed, in part because there were so many process innovations required, and the business unit was unable to invest in developing that deep of a relationship with the external partner to help it devise the new production approach. Ultimately the champion built the business within R&D, using R&D’s facilities traditionally used for fabricating prototypes to conduct the needed higher-volume manufacturing. Within a few years this medical-imaging business grew to become a major game changer in its field and for the company, but our champion’s boss retired, and he retired too early. He told us, “The idea of having someone champion the project, have a vision for it, and push it and push it and push it and push it is what makes it successful.” But pushing too hard can raise the hair on the backs of other important political players’ necks. He didn’t have a chance of succeeding politically once his senior sponsor could no longer provide cover.

In another of our participating companies, a business director for an emerging business told us that there was no upward mobility for him in his current role. His line of reporting was through the chief technology officer, who lacked business creation expertise. He therefore received little guidance regarding the business’s development, and certainly would never assume his boss’s role. He perceived that his only way to succeed was to make sure his business succeeded so that he could become its general manager. He’d been nurturing the opportunity for four years in the hopes that this would happen, but it was taking too long, and there were no guarantees. Even with all his hard work, uphill battles, and signs of success, he’d been promoted only once during the time he was incubating this business, which was viewed as strategically important for the company. The colleagues in the operating unit that he’d left to assume this role had been promoted multiple times. The business director claimed that he was not doing this gig for the money, but for the possibility of a big success story (the once-every-ten-years big hit). He appreciated the visibility he was getting from senior management, but, unfortunately, the one that mattered most to him retired during this time. Eventually he left this role and moved back to his previous business unit. Today he’s the divisional vice president. That’s great for him, and perhaps good for the division he’s running, but not so great for the new business he left. This ambitious guy had to wait too long for the recognition and position of influence he sought. Incubation takes a very, very long time.

Finally, we encountered a vice president of science and technology in yet a different company who considered his most recent assignment as punishment for transgressions he’d committed in his attempts to grow a new business area. While his current title was certainly impressive, he was not happy with the associated responsibilities, which were to develop and lead innovation best practices across the company. “I am in the penalty box. I feel like an experienced quarterback with a broken leg . . . on the sidelines.” Why had this talented person been sidelined? He’d had a big idea, built a venture, and then was passed over as CTO of the venture he built. He deduced that he’d not been politically sensitive enough when he spoke to others in the company about the venture. He’d burned a few bridges and had not had appropriate strategic guidance to help him understand the consequences of his venture’s success on other aspects of the company’s strategy. By the time we finished our study, he’d opted to take early retirement and is now consulting to companies on how to drive technology-based innovation.

These are but a few of the many pain stories we’ve collected. Talented innovators make political faux pas, lacking proper coaching and strategic guidance, or suffer the consequences of working on highly uncertain projects that cannot meet predicted timetables. They’re not stupid. They’re not lazy. This is the nature of breakthrough innovation. There are far too many examples of people in the wrong roles, or people working without a link to the right leadership, or companies’ ineffective use of innovation talent. On several occasions we encountered research scientists put in the position of having to create market connections and build business platforms on the basis of their discoveries. At one of the companies we studied, a breakthrough opportunity occurred. A promising scientist volunteered to drive the business. He did, but it took him seventeen years to build a business that was recognized as part of the mainstream company. How often does the window of opportunity stay open for that long?

Consequences

These stories may seem unlikely or dramatic. Yet many more exist in every one of the companies we’ve studied. At the end of our four-year study, we contacted each person we had interviewed to learn of any changes in his or her role over the study period. Here’s what we found:

• Of 129 people classified as filling innovation roles, 66 people (51 percent) had left the position after three-plus years—a fairly typical turnover rate of roles in the corporate setting.

• Of those, 71 percent left the company’s innovation function. They had either moved to a business unit or left the company, rather than being promoted within innovation . . . hmm, loss of expertise.

• Of those who left the company 87.5 percent are working in an innovation function for another company or have started their own company.

• More people exited the company than moved within innovation roles.

– 17 percent of study participants left the company over the four-year period.

– 14 percent moved into new innovation related roles within the company.

The implication? By their actions, companies are indicating that they favor losing their innovation talent to competitors over rewarding and retaining it. We know that innovation talent is rare, and we have also learned that many people who have those skills and expertise would rather move companies than take on operational roles. One innovation director told us:

If they put me in charge of a business where there are no opportunities to grow or innovate, they would waste my color . . . I’m not married to any company. I’m attached to who I am, and what I would like to do.

Over the past several years, there’s been a trend to identify a new role of chief innovation officer, but identifying their mandate has been tougher. Executing on it is tougher still. A study by Capgemini Consulting reported that, in 2012, 43 percent of executives responding to their survey indicated that their companies have an innovation executive, compared with 33 percent the previous year. For many companies, the title of chief innovation officer is ambiguous. The Wall Street Journal commented on the study by suggesting that the CNO36 role was industry’s “new toy. Company boards feel that they ought to have one. They just aren’t sure what to do with it.”37 While some companies report finding people who have the right skill, mind-set, clout within the organization, and bandwidth to be able to lead innovation activities, they do not necessarily know what is expected beyond “more innovative ideas.”38

Allocating one expert to handle innovation for a company is unrealistic. What is becoming clear is that companies need deep expertise in innovation. And that means identifying what those roles are. If that doesn’t happen soon, companies will retract their investments even in the CNO position (and, in fact, many have done just that since 2012), and we’ll be back to square one. Companies who compete on the basis of breakthrough innovation must address the problem of talent management in order to build an innovation expertise.

In Chapter 2 we describe the evolution we see among companies to get professional about innovation . . . to move from a concept of breakthrough innovation to strategic innovation. Strategic innovation sets its scope on the far future and cultivates a portfolio of options that will become the company’s next platforms of business. It’s ambiguous. It’s uncertain. It needn’t be unmanageable or excessively risky. It needs to be strategic. We’ll describe the management system for strategic innovation and the competencies that firms must develop to successfully commercialize breakthroughs and other innovative new platforms of business. These were identified in our earlier studies and have been validated by numerous companies in many settings.

But this book focuses on the talent development aspects of the management system, because at its core, instituting innovation roles is the weak link we find in most companies’ innovation management system attempts. We offer a framework of roles that align with the necessary competencies of discovery, incubation, and acceleration that form the basic building blocks for strategic innovation. Later in the book we take up the issue of career paths for innovation personnel. As you have seen, people in innovation roles are more likely to leave their companies than those in other roles, and, perhaps more important, they are more likely to work in innovation roles for other companies than to move to non-innovation-related roles. This means that attention to career paths and job satisfaction for such personnel could greatly enhance a company’s reservoir of expertise for strategic innovation and strengthen its competitive advantage rather than surrendering it to others.

1. See http://www.kodak.com/ek/US/en/Our_Company/History_of_Kodak/Milestones_-_chronology/1878-1929.htm.

2. “Case Flash Forward: Kodak and the Digital Revolution (A),” Harvard Business School Case 6065-PDF-ENG, January 13, 2015.

3. See http://photosecrets.com/the-rise-and-fall-of-kodak.

4. Ibid.

5. Dana Mattioli, “Their Kodak Moments,” Wall Street Journal, January 6, 2012, http://online.wsj.com/news/articles/SB10001424052970203513604577142701222383634. Mike Dickinson, “Kodak’s Local Employment Falls to Nearly 3,500,” Rochester Business Journal, http://rbj.net/2013/03/12/eastman-kodaks-local-employment-falls-to-near-3500/, March 12, 2013.

6. See https://en.wikipedia.org/wiki/Nortel.

7. Dorothy Leonard-Barton, “Core Capabilities and Core Rigidities: A Paradox in Managing New Product Development,” Strategic Management Journal 13, no. S1 (1992): 111–125.

8. William Lazonick, “Profits Without Prosperity,” Harvard Business Review 92, no. 9 (2014): 46–55.

9. See http://www.wsj.com/articles/hillary-gets-it-right-on-short-termism-1438124913.

10. Ibid.

11. Roger L. Martin, “The Rise (and Likely Fall) of the Talent Economy,” Harvard Business Review 92, no. 10 (2014): 40–47.

13. Lazonick, “Profits Without Prosperity”; Martin, “Rise (and Likely Fall)”; and private conversation with the chief innovation officer of a Europe-based company.

14. Norman D. Fast, “New Venture Departments: Organizing for Innovation,” Industrial Marketing Management 7, no. 2 (1978): 77–88; Josh Lerner, “Corporate Venturing,” Harvard Business Review 91, no. 10 (2013): 86.

15. Christopher M. McDermott and Gina Colarelli O’Connor, “Managing Radical Innovation: An Overview of Emergent Strategy Issues,” Journal of Product Innovation Management 19, no. 6 (2002): 424–438.

16. See http://www.economist.com/node/15048819.

17. See, for example, Joseph L. Bower, Managing the Resource Allocation Process: A Study of Corporate Planning and Investment (Boston: Harvard Business School Press,1970); Robert A. Burgelman, “A Process Model of Internal Corporate Venturing in the Diversified Major Firm,” Administrative Science Quarterly 28 (1983): 223–244; N. D. Fast, The Rise and Fall of Corporate New Venture Departments (Ann Arbor, MI: UMI Research Press, 1978); Gifford Pinchot, Intrapreneuring: Why You Don’t Have to Leave the Organization to Become an Entrepreneur (New York: Harper and Row, 1985).

18. Robert G. Cooper, Winning at New Products: Accelerating the Process from Idea to Launch (New York: Basic Books, 1985).

19. Robert G. Cooper, “Third-Generation New Product Processes,” Journal of Product Innovation Management 11, no. 1 (1994): 3–14.

20. Rajesh Sethi and Zafar Iqbal, “Stage-Gate Controls, Learning Failure, and Adverse Effect on Novel New Products,” Journal of Marketing 72, no. 1 (2008): 118–134.

21. Eric Reis, The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses (New York: Crown, 2013).

22. See http://www.forbes.com/innovative-companies/list/.

23. See https://hbr.org/1999/09/creating-breakthroughs-at-3m.

24. See http://multimedia.3m.com/mws/media/1084292O/3m-announcing-med-tech-external-press-release-pdf.pdf.

25. Louis V. Gerstner Jr., Who Says Elephants Can’t Dance? Leading a Great Enterprise Through Dramatic Change (New York: HarperCollins, 2002).

26. Rosabeth Moss Kanter, When Giants Learn to Dance (New York: Simon and Schuster, 1990).

27. Interview with Joanne Hyland, previous vice president of Nortel Networks.

28. Alex Salkever, “Nokia’s Security Connection,” BusinessWeek Online, September 10, 2002, https://www.bloomberg.com/news/articles/2001-08-27/nokias-security-connection; Jonathan D. Day, Paul Y. Mang, Ansgar Richter, and John Roberts, “The Innovative Organization,” McKinsey Quarterly 2 (2001): 21–31; Katherine Doornik and John Roberts, “Nokia Corporation: Innovation and Efficiency in a High-Growth Global Firm,” Stanford University Case Number S-IB-23, February 2001, http://www.nokia.com/en_int.

29. See http://www.nytimes.com/2015/07/09/technology/microsoft-layoffs.html?_r=0.

30. Charles A. O’Reilly, J. Bruce Harreld, and Michael L. Tushman, “Organizational Ambidexterity: IBM and Emerging Business Opportunities,” California Management Review 51, no. 4 (2009): 75–99.

31. Presentation by Mike Giersch, vice president, strategic planning, IBM Corporate Strategy Office (copresented with Gina O’Connor), at the IIR/PDMA Front End of Innovation conference, May 2007.

32. Mehrdad Baghai, Stephen Coley, and David White, The Alchemy of Growth: Practical Insights for Building the Enduring Enterprise (Boston: Da Capo Press, 2000).

33. Giersch presentation.

35. See http://www.globalcorporateventuring.com/; see also https://www.bcgperspectives.com/content/articles/innovation_growth_mergers_acquisitions_corporate_venture_capital/?chapter=2.

36. We use the acronym CNO rather than CIO to reduce confusion with the chief information officer role that exists in many companies.

37. See http://blogs.wsj.com/cio/2012/04/03/chief-innovation-officers-the-growth-of-the-other-cio/.

38. Ibid.