Capitalism is today under siege—from Bernie Sanders’s democratic socialist indictment that unfettered capitalism is to blame for our unprecedented levels of inequality and climate crisis, to entrepreneur Vivek Ramaswamy’s free-market admonition that stakeholder or “woke” capitalism is little more than a corporate game of pretending to care about something other than profit and power, precisely to gain more of both.1

Regardless of economic ideology or political persuasion, however, there can be no doubt that the last four decades have witnessed environmental impacts and social disparities that were unimaginable even during my childhood years in the 1950s and 1960s. While capitalism has indeed produced some of the most amazing advancements in all of human history, the business mindset of shareholder primacy has pitted financial returns against human needs and environmental integrity. What economists have traditionally referred to as “negative externalities”—those damages imposed on society by economic exchanges for which no market price is paid—are no longer peripheral issues. In a very real sense, negative environmental and social externalities have now become the main event.2

As a consequence, recent years have witnessed a growing chorus of scholars, pundits, and practitioners calling for a fundamental reinvention of capitalism.3 As unique and unprecedented as our current conundrum feels, however, it is important to realize that the current groundswell to “reimagine” capitalism is not the first time that the venerable economic system has undergone significant transformation. “Animal spirits” have gotten out of control in the past—only to be tamed by our “better angels.” Indeed, capitalism has experienced structural crisis—and been “remade”—at least two times before. Numerous authors have traced various aspects of the trials and tribulations of the capitalist endeavor over the past five centuries.

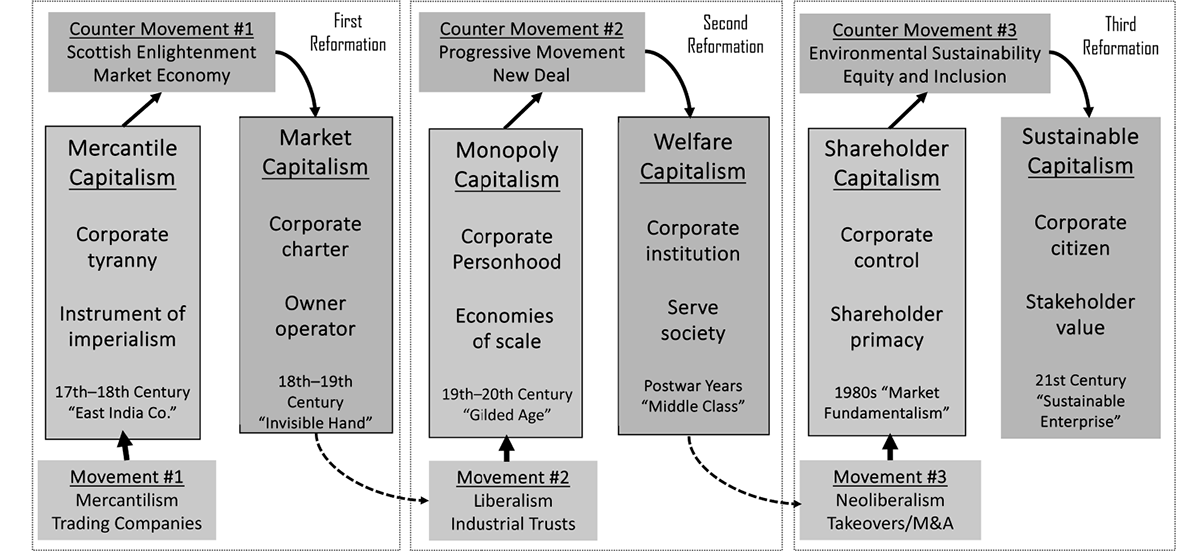

In this chapter, I summarize and describe in depth the emergence of capitalism and its first two cycles of reformation, as displayed in Exhibit 1.1, beginning with the European “Age of Exploration” in the fifteenth and sixteenth centuries. There are important lessons to be learned from this history that are relevant for our time—the third reformation—which will be considered in depth in the next chapter. Let the exhibit serve as your guide for the first part of the book as we explore the roots of our current predicament. Before starting this journey, however, allow me to briefly reflect on the roots of the capitalist idea itself. Where did it come from and how did capitalism first emerge in the world?

Markets and trade are as old as human civilization. As John McMillan points out in Reinventing the Bazaar, the urge to engage in “business” seems to be part of the human experience, at least since the time of the Agricultural Revolution. Throughout recorded history, humans have traded with each other and engaged in exchange relationships for mutual benefit. Adam Smith noted “man’s propensity to barter, truck, and exchange with one another.” Markets and bazaars have flourished for thousands of years. Mesopotamians charged interest on loans before they discovered how to put wheels on carts. The invention of money only accelerated this phenomenon by making it easier to exchange value.4

Yet for most of Western history, until about the sixteenth century, economic stagnation—a true “steady-state”—was the natural order of things: per capita income barely grew for well over a millennium, from the fall of the Roman Empire until the fall of feudalism—the so-called “Middle” and “Dark” Ages.5 The ideas of progress and social mobility were nonexistent. Aside from kings and nobles, most people spent their entire lives within a few miles of where they were born, laboring as serfs or slaves. Life truly was, as Thomas Hobbes quipped, “nasty, brutish and short.” As Daron Acemoglu and James Robinson so astutely observed in Why Nations Fail,

The fear of creative destruction is the main reason why there was no sustained increase in living standards between the Neolithic and Industrial Revolution. Technological innovation makes human societies prosperous, but also involves the replacement of the old with the new, and the destruction of economic privileges and political power of certain people. . . . Prior to seventeenth-century England, extractive institutions were the norm throughout history . . . [they] did not permit creative destruction.6

Historians have nonetheless recognized the existence of long-distance trading as a commercial activity, dating back to the days of the Silk Road and great East-West trading routes through the Indian Ocean. The Chinese engaged in long-distance trade carried out by independent merchants all the way back to the time of the Han dynasty (206 BC–220 AD) as did the Arabian Empire between the seventh and mid-thirteenth centuries, encompassing western Asia, North Africa, and the Iberian Peninsula.7

Europe, however, was a relative latecomer to trade and remained “backward” for a long time as feudalism gripped the continent following the fall of the Roman Empire. India, China, and the Islamic world were far more developed by comparison. Only in the twelfth century did the northern Italian cities (such as Venice, Florence, Genoa) become actively engaged in long-distance trade, with large fortunes accumulated by the financiers and merchants involved. Yet even as long-distance trade in Europe lagged that of the East, it would eventually emerge as the most dynamic.8

Early long-distance trade could best be described as “precapitalist” in that its impact on society was quite limited, described by historian Jürgen Kocka as “little capitalist islands in a sea of non-capitalist, subsistence conditions.”9 The dawning of the European Age of Exploration, however, set the stage for the emergence of capitalism as a societal order. It all started in the fifteenth century, with the commercial exploitation of the west coast of Africa for its gold, ivory, and slaves. These profit-seeking sea voyages captained by “explorers” such as Christopher Columbus, Amerigo Vespucci, and Vasco da Gama were financed by the Portuguese and Spanish crowns in combination with wealthy Italian merchant-financiers. In fact, the African trade is where Christopher Columbus (Cristoforo Colombo in his native Genoa) began his seafaring, raiding, and slaving career.10

At the time, Europe was mired in a prolonged “bullion famine.” The exhaustion of European gold and silver mines combined with a high trade deficit with the more prosperous East had created a drastic shortfall in precious metals. Put simply, Europe’s exports—mainly woolens and cloth—were less valuable than its imports. Bullion (gold and silver) was the only thing that could purchase the spices, silks, and other luxuries that European aristocrats craved, which explains in part the mercantilist obsession with bullion as the ultimate measure of national wealth. While short on bullion, Europe did however have a well-developed system for financing long-distance sea voyages, built on the extensive experience of the Italian merchants and financiers.11

As historian Patrick Wyman importantly points out in The Verge, the Portuguese and the Spanish added critical new dimensions to the Italian commercial model that would become core to the system of mercantile capitalism that was to take over the world in the sixteenth century:

One thing stands out about this milieu: a distinct orientation toward profit-seeking, combined with a willingness to inflict violence. Strong religious sentiments, namely the concept of crusading, and the ideals of knightly chivalry wove themselves into a tapestry of lucrative bloodshed. Early Atlantic adventurers . . . were hardly bold, altruistic explorers seeking out new knowledge in distant and uncharted waters. They were operating within a world of violent commercial enterprise where religious war and profit hunting went hand in hand.12

The African commercial model was then spread to the East and to the New World at a time when Martin Luther’s Protestant Reformation was simultaneously fomenting religious upheaval across Christian Europe. Vasco da Gama’s 1497 voyage around the Cape of Good Hope opened the ocean route around Africa to India and Asia—the richest trading system in the world. The Portuguese aimed to dominate the trade in spices from the Indies, reaping huge profits from importing cloves, cinnamon, ginger, pepper, gold, pearls, and silk, along with exporting healthy doses of piracy, holy war, and barbarism. Bullion filled the royal coffers, and merchant investors grew immensely wealthy.13

Columbus’s “discovery” of the Americas in 1492 would prove ultimately to be the most transformational event of the Age of Exploration. Initially, however, he was convinced he had found the way around the rim of the Indian Ocean to the East. Money poured in for follow-up expeditions, but it soon became apparent that what Columbus had found was not an easy passage to the East but rather an entirely new continent—one without much in the way of gold (at least initially) and bereft of developed markets for luxury goods back home. It was after this realization that Columbus first floated the idea of enslaving people on a massive scale as a way of making the expeditions pay off, just as they had done in West Africa. The brutal tactics Columbus employed, including the mass exploitation of the native population, and slaving as a business model, set the tone for the Conquistadors to follow—Cortés in Mexico and Pizarro in Central and South America.14

The empires of the Aztec and the Inca fell within a generation of Columbus’s initial voyage. Enslavement and religious conversion went hand in hand, justifying not only the genocidal conquests of natives but also their enslavement to produce gold and silver. The early sixteenth century also witnessed the beginning of the transatlantic trade of permanently enslaved Africans: to build the highly profitable plantation economies that came to define the New World—sugar, tobacco, rice, and later, cotton—an estimated twelve million African people would be enslaved and sold to fledgling “capitalists” whose corporations were the instruments of New World settlement.15

The first enslaved Africans were shipped to the Americas in 1518, one year after Martin Luther nailed his 95 Theses to the church door in Germany. It was their uncompensated labor that helped fuel the economic growth of the New World and the rise of Europe as the dominant force in the world. Could the practices from the Spanish and Portuguese exploitation of West Africa be the source of capitalism’s view of labor as a “factor of production”—a cost to be minimized? Could the centrality of the profit motive—largely unconstrained by rules and justified by religion—also have its origin in the early days of the Age of Exploration? Was it here where the primordial DNA for what was to become the first age of capitalism—mercantilism—in the seventeenth century was first established?16

While the term “capitalism” rose to prominence only in the mid-nineteenth century, as the first Industrial Revolution reached its zenith, it is clear from the previous section that the core ideas and practices have much older roots.17 As we saw, use of the term “capitalist” can be traced all the way back to the fifteenth century, when it was used to describe the very “capital-rich men”—the Italian merchants and financiers who “brokered or dealt” in capital—who lent the money for all those long-distance voyages of exploration and exploitation.18

It was England and Holland, however, that began to develop a new kind of commercial infrastructure that extended beyond the finance of long-distance seafaring, penetrating into the world of production, with the advent of commercial farming and, later, cottage industry.19 In fact, it was the emergence of English agrarian capitalism—with its enclosure of common lands, tenant farmers, and large landholdings—that appears to have created the preconditions for a truly capitalist society to emerge: commercial farming first established the ethic of competition, productivity growth, and “improvement,” resulting in the waves of landless peasants (failed tenant farmers and those forced off the enclosed commons) who later became the wage laborers in the textile mills and factories of the first Industrial Revolution.20

It was in this context that the capitalist mentality first emerged as part of a larger societal transformation—what Adam Smith later described as the creation of a “commercial society,” in which most goods and services are produced by companies for profitable exchange, and people—no longer self-sufficient—become participants in and dependent upon markets. It turns out that, beginning in the seventeenth century, English and Dutch “trading companies” played a crucial role in helping bring about this capitalist transformation, and much of this change related directly to the emergence of cotton and textiles as a global industry.21

The Age of Exploration also ushered in the Enlightenment, and along with it, a fundamental change in worldview by the masses. The world was no longer seen as flat, but rather as a round globe, revealing an entire “New World” unbeknownst to most Europeans before.22 The earth was also no longer the center of the universe, but simply one of myriad planets rotating around countless stars like the sun. Starting in the sixteenth century, the Scientific Revolution introduced a whole new way of making sense of the world—through reason and the evidence of the senses, making it possible to discover and harness the laws of nature for the presumed betterment of humanity.23 It was at this point that the Europeans began their steady ascent to economic, scientific, and military dominance in the world, finally surpassing the Middle East, India, and China in the nineteenth century.

At its core then, capitalism is really a mindset—a way of looking at the world—and the new “capitalist” way of thinking was forged in the crucible of the Age of Exploration. The Oxford English Dictionary gives a succinct definition of the term “capital”: “accumulated wealth, reproductively employed.”24 As Thomas McCraw notes in his classic Creating Modern Capitalism, history is replete with empires and rulers that accumulated massive wealth—witness the pyramids in Egypt, the Forbidden City in China, or the cathedrals of Europe—but the accumulated wealth put to these uses was not “reproductively employed.”25

Queen Elizabeth first legalized lending at interest in 1571, distinguishing commercial pursuits from the long-reviled “usury” charged by traditional moneylenders. With the ensuing rise of mercantilism and the Industrial Revolution, the world witnessed for the first time the investment of wealth for future gain. Innovation and progress became the watchwords, with old technologies and organizational forms swept out by the new. As Edward Chancellor insightfully noted, “Without interest, there could be no capital; without capital, no capitalism.”26

With international trade, finance, and commerce on the rise, burghers (town dwellers), gentry (commercial farmers), manufacturers, and merchants began to overcome the hold of the monarchy and the feudal lords on the social and economic order. Increasingly, people came to see that they had agency to change their lot in life; they were not subject only to royal authority and outside forces beyond their control. Progress was now possible, whereby one’s life might materially improve compared to that of one’s parents or grandparents.27

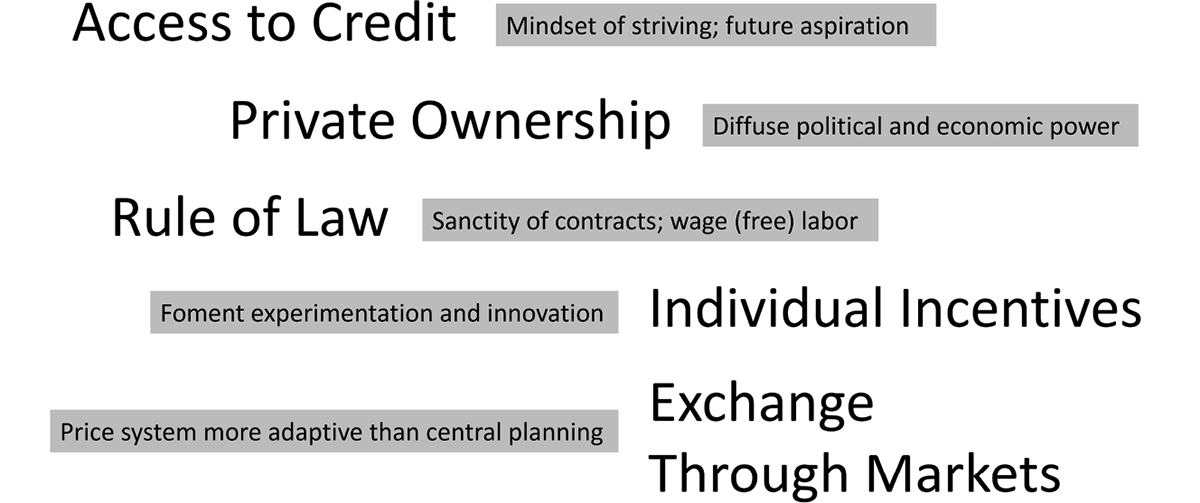

And thus, the “capitalist mentality” was born. Capitalist thinking is all about making bets on the future—a psychological orientation toward the pursuit of prosperity. It’s all about aspiration and striving, as measured by gains or losses in wealth and well-being. Capitalism rests on the assumption that economic growth is not only possible, but desirable, for individuals, families, communities, businesses, and countries.28 As economist Joseph Schumpeter noted, [T]he atmosphere of industrial revolutions—of “progress”—is the only one in which capitalism can survive . . . stabilized capitalism is a contradiction in terms.”29 Such growth and innovation are best achieved, according to the capitalist logic, through access to credit, private ownership, rule of law, individual incentives, and exchange through markets, rather than central planning or authoritarian control (Exhibit 1.2).

The European Age of Exploration unleashed an economic boom unlike any other in human history. At the time, nature was seemingly limitless while capital was scarce, so it made sense to reward capital above all else.30 The European colonization of the Americas produced a fledgling new civilization premised on land expropriation, slave labor, resource exploitation, and the “settling of the frontier.”31 In the process, this expansion all but extinguished the native population that had inhabited the continent for thousands of years. By some estimates, the death toll among indigenous peoples in the Americas after first contact with the Europeans, through either war or disease, was somewhere between fifty and eighty million people—a civilizational collapse so massive that it may have contributed to the so-called Little Ice Age: as native lands reverted to nature, they drew so much carbon out of the atmosphere that it may have actually lowered the global temperature.32

Starting in the seventeenth century, this capitalist mentality spread like a global pandemic such that it became the social and economic order in the West by the early nineteenth century, and established England and Europe as the dominant economic and military forces in the world.33 The vehicle most responsible for fomenting this new mentality and dominance was the government-chartered corporation known as the “trading company.” It was an entirely new breed of organization, fundamentally different from traditional royally chartered corporations, which focused on delivering local public goods like roads and bridges or the administration of municipalities or universities.

It would not be an overstatement to say that the Age of Exploration would not have been possible were it not for this new corporate form, financed through an innovation known as “adventure capital.”34 As we saw with Christopher Columbus, a ship or an entire fleet sailing off into the Atlantic required large up-front investments in vessels, supplies, and sailors to crew them. Beginning in the early 1500s, groups of wealthy merchants and nobles banded together to form investment partnerships enabling individual members to participate in commercial expeditions of their choosing. The Fellowship of Merchant Adventurers in England, for example, dates to 1505. As the century progressed, however, it became increasingly apparent that a more flexible organizational form was needed to spread the risk for investors, since the probability of any single overseas venture succeeding was low.

What emerged was the invention of the “joint-stock” company, which enabled wealthy individuals to buy transferable shares in an actual corporation. This corporation would then invest in a portfolio of expeditions, increasing the likelihood that at least one of them would hit pay dirt in the form of gold, silver, ivory, spices, furs, rubber, saltpeter, timber, or slaves, and later, indigo, tobacco, rice, sugar, and cotton grown on slave plantations. This corporate form, which spread risk by diversified investments for individual investors, anticipated the modern notion of private equity and venture capital.35

Joint-stock trading companies were run by and for the shareholders—the ancient roots of shareholder primacy. Power was controlled by a narrow group of wealthy merchants—the mercantile aristocracy—on the Court of Directors. All shareholders met quarterly to hear the directors’ report and vote on corporate strategy and policy, with particular attention paid to sustaining high rates of dividend payments. The directors also oversaw the operations, with weekly board meetings to determine policy and strategy. Precise orders would then be sent to the overseas subsidiaries, implemented through a system of subsidiary presidents or “governors.” Given the distance and time delay in communications, directors gave considerable discretion to local management to determine how best to carry out directives and achieve specific goals.36

The crown government took additional steps to sweeten the pot by limiting the potential loss of any individual investor, shielding them from liabilities beyond their initial investment, should the expeditions incur additional problems and costs (which they typically did) or failed outright. Thus, the idea of limited liability, which is a key feature of the modern corporation, was advanced in the Age of Exploration to further encourage private capital to invest in risky overseas ventures by limiting the downside risk. Indeed, while the Portuguese and Spanish were the “first to market” when it came to sea routes to the East and exploration of the New World, the Dutch and the English were the organizational innovators, first enabling such voyages to be financed entirely by private capital in the form of joint-stock, limited-liability corporations.

Thus the goal or objective function of this new mercantilist form of capitalism was not particularly new. Indeed, the use of power to accumulate riches dated back to the dawn of human civilization. What was revolutionary was the operating system and narrative myth enabling and justifying the endeavor: it was the first time a merchant-financier class (in collaboration with the crown) invested for financial gain at scale using new organizational instruments designed specifically for the purpose—adventure capital and the joint-stock, limited-liability corporation. The narrative myth used discovery and religious crusading to justify the wholesale subjugation of native populations and enslavement as a business model. Resource extraction, the quest for profits, unconstrained by rules or limitations, and the primacy of shareholders formed the cornerstones for the new system.

And so were established the core features of capitalism for the next four hundred years, characterized by repeated cycles of excess and exploitation followed by reform and reinvention in reaction to its most devastating and pernicious consequences.

1. Bernie Sanders, It’s OK to Be Angry About Capitalism (New York: Crown, 2023); Ramaswamy, Woke, Inc.

2. William Steffens, et al., “Planetary Boundaries: Guiding Human Development on a Changing Planet,” Science 15 (January 2015); Duncan Austin, “Win-Win in the Time of Net Zero: A Tale of Two Sustainabilities,” 2021, https://bothbrainsrequired.com/wp-content/uploads/2021/05/2021-05-17-Win-Win-in-the-Time-of-Net-Zero-Final-16pp.pdf.

3. John Elkington, Green Swans (New York: Fast Company Press, 2020); Rebecca Henderson, Reimagining Capitalism in a World on Fire (New York: Hachette Group, 2020); Paul Polman and Andrew Winston, Net Positive (Boston: Harvard Business Review Press, 2021); Philip Kotler, Confronting Capitalism (New York: American Management Association, 2015); Andrew Winston, The Big Pivot (Boston: Harvard Business Review Press, 2014); James O’Toole, The Enlightened Capitalists (New York: HarperCollins Publishers, 2019); Dominic Barton, Dezso Horvath, and Matthias Kipping, eds., Re-Imagining Capitalism (Oxford, UK: Oxford University Press, 2016), David Grayson, Chris Coulter, and Mark Lee, All In: The Future of Business Leadership (London: Greenleaf,2018).

4. John McMillan, Reinventing the Bazaar: A Natural History of Markets. (New York: W.W. Norton, 2002).

5. Jeffrey Sachs, The End of Poverty: Economic Possibilities for Our Time (New York: Penguin, 2006).

6. Daron Acemoglu and James Robinson, Why Nations Fail: The Origins of Power, Prosperity, and Poverty (New York: Currency, 2012), 183–184.

7. Peter Frankopan, The Silk Roads: A New History of the World (New York: Vintage Books, 2015).

8. Jurgen Kocka, Capitalism: A Short History (Princeton, NJ: Princeton University Press, 2016).

9. Ibid.

10. Patrick Wyman, The Verge: Reformation, Renaissance, and Forty Years That Shook the World (New York: Hachette Book Group, 2021).

11. Ibid.

12. Ibid, 26.

13. Acemoglu and Robinson, Why Nations Fail.

14. Wyman, The Verge.

15. Nell Irvin Painter, The History of White People (New York: W.W. Norton, 2010).

16. Jay Coen Gilbert, “Larry Fink, Tucker Carlson, David Brooks and the Call for a Capitalist Reformation,” 2019, https://www.forbes.com/sites/jaycoengilbert/2019/01/24/larry-fink-tucker-carlson-david-brooks-and-the-call-for-a-capitalist-reformation/.

17. Fernand Braudel, The Wheels of Commerce. (Berkeley, CA: University of California Press, 1992).

18. Kocka, Capitalism.

19. Ellen Meiksins Wood, The Origins of Capitalism (New York: Verso Books, 2017).

20. Ibid.

21. Sven Beckert, Empire of Cotton: A Global History (New York: Vintage Books, 2014).

22. Of course, the educated had long known that the earth was round. The Greek mathematician Eratosthenes actually measured its circumference in 240 BC.

23. Francis Bacon, Novum Organum (London: Clarendon Press, 1878).

24. As quoted in Thomas McCraw, ed., Creating Modern Capitalism (Cambridge, MA: Harvard University Press, 1997), 3.

25. Ibid.

26. Edward Chancellor, The Price of Time: The Real Story of Interest (New York: Atlantic Monthly Press, 2022), 27.

27. Stuart Hart, “The Environmental Movement: Fulfillment of the Renaissance Prophesy,” Natural Resources Journal 20, no. 3 (1980): 501–522.

28. McCraw, Creating Modern Capitalism.

29. Joseph Schumpeter, Capitalism, Socialism and Democracy, 3rd ed. (New York: Harper, 1950), 209.

30. Now, of course, we are awash in capital and nature has become scarce, so the original logic no longer applies. See, for example, Paul Hawken, Amory Lovins, and Hunter Lovins, Natural Capitalism (Boston: Little, Brown, 1999); Peter Barnes, Capitalism 3.0 (San Francisco: Berrett-Koehler, 2006).

31. Walter Prescott Webb, The Great Frontier (Austin: University of Texas Press, 1964).

32. Elkington, Green Swans.

33. Kenneth Pomerantz, The Great Divergence: China, Europe, and the Making of the Modern World Economy (Princeton, NJ: Princeton University Press, 2000).

34. Bhu Srinivasan, Americana: A 400-Year History of American Capitalism (New York: Penguin, 2017).

35. Ibid.

36. Nick Robbins, The Corporation That Changed the World (London: Pluto Press, 2006).