The 2007–2008 financial crisis brought the previously esoteric topic of consumer loan pricing to the front page of every newspaper in the world. As in previous financial crises, in 2007 and 2008 global credit markets “seized up,” which makes it sound as if the pistons of a giant engine had jammed in place.1 What really happened was a failure of pricing—lenders lost faith in their ability to price loans to their customers and the institutions that bought bundles of loans from lenders lost faith in their ability to evaluate those bundles. As a result loans and loan derivatives were unavailable at any price. The result was the most prolonged and damaging economic recession in the West since the Great Depression of the 1920s.

While the causes of the 2007–2008 financial crisis have been widely debated in both academic books and in the popular press, it is universally agreed that one of the major contributors (some would argue the major contributor) to the collapse of the financial system was feckless consumer lending. Lenders in the United States, the United Kingdom, and elsewhere made too many foolish loans to customers who should never have gotten a loan in the first place. Other loans were offered at prices that did not reflect the true risk of the loan. Why lenders felt it was a good idea to issue so many foolish loans and why the systems were not in place to protect the global economy from the consequences of their foolishness are topics for another book. The topic of this book is the more tactical question of how lenders should price their loans to best achieve their business goals while also controlling risk. The approach described in the book is called price optimization. Price optimization involves creating mathematical models of how customers respond to prices and calculating how prices influence the profitability and risk of different loans. Once these steps are complete, optimization algorithms can be used to find the prices that best balance demand and profitability to meet corporate goals. Adopting price optimization enables lenders to improve profitability and control risk; ideally, it will keep them from issuing too many unsound loans and offering them at foolish prices.

Price optimization was first used by passenger airlines under the name revenue management to set and update their prices following deregulation.2 Passenger airlines use their rich information about customers to vary prices dynamically in order to balance demand and supply and to maximize profitability. Following its widespread (and widely heralded) success in the passenger airline industry, the idea of using mathematical analysis to vary prices dynamically in response to market changes spread to many other industries. Online retailers have become particularly adept at the practice.

For lenders, price optimization means applying statistical analysis (aka machine learning) to customer data in order to estimate how future applicants will respond to different prices for different types of loans. (For a loan, the primary element of price is the interest rate; however, various fees and other charges may also contribute to the price.) These estimates of price response are used by an optimization model that sets the prices for all loans to all customer types through all channels in order to maximize profitability while also controlling risk.

Lenders have four advantages relative to other retailers when it comes to price optimization:

1. Lenders have access to a vast amount of information about every loan applicant, and that information is of a depth and richness that is the envy of most other retailers. Lenders have available to them all the information they receive with the loan application as well as the information in the applicant’s credit file. Even online retailers such as Amazon do not have access to such in-depth information about their customers.

2. Consumer lenders, unlike many retailers, do not need to worry too much about arbitrage. Consumers who are issued a loan at an attractive price are unlikely to use that as an opportunity to become a lender themselves.

3. Most lenders have already established complex pricing structures that require periodically setting and updating thousands or tens of thousands of prices. For example, a large home-equity lender in the United States varies prices on the basis of size of loan, term, resident state of applicant, loan-to-value ratio (LTV), combined loan-to-value ratio (CLTV), and risk band. When all the combinations of dimensions are counted, the lender is setting tens of thousands of loan prices. This is both a challenge and an opportunity. It is a challenge to set and manage so many prices. It is an opportunity because the large number of prices enables the lender to target pricing specifically to the needs and characteristics of different customers.

4. Many lenders have sophisticated analytical groups in-house and have both the personnel and infrastructure to implement price optimization.

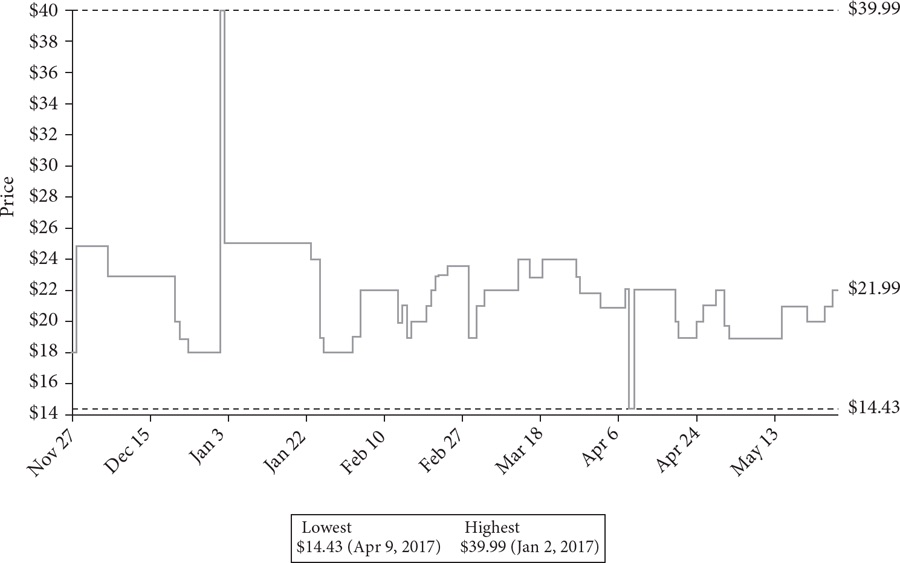

Despite these advantages, the retail lending industry has been slow to adopt price optimization—much slower than most other retailers, many of whom have adopted highly sophisticated systems for dynamic pricing. For example, Figure INT.1 shows the price that Amazon displayed on its website for a randomly chosen product (a 50-pack of velvet suit hangers) for a 6-month period.3 Over this period, Amazon varied the price from a low of $14.43 to a high of $39.99. Amazon’s computerized pricing algorithms continually adjust the prices of tens of thousands of items for sale online in response to changes in cost, competitive actions, inventory levels, and overall market demand. In addition, Amazon periodically performs price tests to gauge the price sensitivity of their customers to different products. The result is prices that can change very frequently—as with the pack of hangers in Figure INT.1, for which the price changed 44 times in three months, or about once every other day. This frequency of change is not atypical; Amazon, for example, changes the prices of some items many times daily. Many other online retailers, including those that sell through Amazon’s platform, also utilize computerized algorithms to set and update prices. In most cases, these companies would consider their ability to adjust prices intelligently over time to be a critical factor in their ability to compete.

Most retail lenders are nowhere near Amazon’s level of pricing sophistication. It is reasonable to ask why—given the advantages enumerated above—retail lenders have been laggards in adopting price optimization. One reason seems to be the fact that, for most of history, pricing was an afterthought for most lenders. Until well into the 1980s, most banks offered a single consumer-lending product—mortgages—at a single rate. Mortgage prices were set to recoup costs, including expected losses, plus a margin. Prices needed to be updated only when the cost of capital changed. It has been said that loan pricing in this era was based on the three-six-three rule: “Borrow at 3%, lend at 6%, on the golf course by 3:00.” While facetious, this reflects the fact that retail loan pricing was for a long time extremely simple and required little sophistication.

Another reason lenders have been slow to adopt price optimization may be the natural conservatism of the industry. As one bank executive put it, “No bank wants to be first to adopt a new technology and no bank wants to be third.” Lenders may also be concerned that adoption of price optimization will bring unwanted regulatory attention. This should not be a major concern: as long as proper constraints are applied, the results of price optimization can always be brought into compliance with regulation; price optimization is a way of improving on what a lender would otherwise be doing manually. Nonetheless, the concern persists: not surprisingly, these concerns appear to be the strongest in countries with the most active financial regulatory agencies such as the United States.

Although the industry lags online retail, large lenders have begun to adopt price optimization. For competitive reasons, banks are understandably reluctant to publicize their use of price optimization. However, at least 20 leading retail lenders worldwide have adopted some form of price optimization. For example, a Canadian bank reported that it realized $33 million in additional net interest margin on its unsecured loan portfolio as a result of price optimization.4

This book serves as a practical introduction for a lender considering the possibility of price optimization or for a researcher interested in how price optimization applies to lending. It provides an introduction to the basic concepts of price optimization, including consumer demand modeling, segmentation, and optimization. It also covers topics specific to lending—in particular risk and the calculation of loan profitability. Most of these topics have been covered elsewhere, but this book brings them together in a single place to show how a lender can use data that it has available (or can easily acquire) in a process that enables it to maximize profitability or meet other business goals.

Organization of the Book

The following two chapters of the book provide some background on the retail lending industry and the critical concept of risk. Chapter 1 presents an overview of the consumer-lending market, beginning with a brief history of consumer credit, followed by a discussion of the primary sources and forms of consumer credit in use today as well as the most common processes by which consumer credit is priced and prices are communicated to customers. Chapter 2 describes the sources and types of risk involved in a loan and shows how this risk can be quantified and estimated using historical data from credit scores. The final section of Chapter 2 describes a model of price-dependent risk. Much of the material in these two chapters—with the exception of the section on price-dependent risk—is likely to be familiar to those with experience in the industry.

Optimizing the price of a loan requires understanding two fundamental relationships: how the profitability of the loan changes as a function of its price and how demand for the loan depends on its price. Chapter 3 addresses the first relationship, detailing how the profitability of a loan can be calculated as a function of its price and other factors such as size and term. It also discusses the relationship of risk and loan price and why a lender with a large portfolio of loans should act “risk-neutral” in pricing an incremental loan. While determining the profitability of a loan requires somewhat tedious calculations, the underlying idea that price optimization is based on incremental revenue and cost is extremely important.

Understanding how the demand for a loan will change as a function of its price is the topic of Chapters 4–6. Chapter 4 describes the basics of price sensitivity and how (and why) the number of people who will take up a loan at different prices can be captured in a price-response curve. Chapter 5 discusses different methods for estimating price sensitivity. The primary focus of this chapter is describing how logistic regression can be used to fit a price-response function to historical loan demand data; however, it also discusses the use of other machine-learning approaches. Chapter 6 discusses how customer, loan, and channel attributes influence price sensitivity and how differences in price sensitivity along those dimensions can be used to segment customers. Taken together, the three chapters provide a self-contained primer on price sensitivity, starting with the basic concepts and proceeding through techniques for estimating price sensitivity and for segmenting loan transactions.

Chapter 7 is something of a capstone: it shows how the calculations of incremental profit and price response can be combined to find optimal prices. It starts with the case of finding the optimal price for a simple loan with price-dependent risk. It proceeds to cover how prices for a large set of different loans being offered to different customer segments through different channels can be optimized in the presence of multiple business constraints. Finally, it discusses how an efficient frontier can be used to illustrate the trade-off between two different objective functions, for example, maximizing profit versus maximizing lending balances.

The models of consumer price response developed in Chapters 4–6 and utilized in optimization in Chapter 7 are based on the assumption that consumers make decisions in an economically rational fashion. Research in behavioral economics has shown that this is a simplistic view of the world and that consumers consistently deviate from the assumptions of rationality. Chapter 8 discusses these deviations and how they might influence loan pricing, as well as their implications for regulators.

Appendix A presents some basic mathematical results on series and discounting that are used in the book, and Appendix B derives some of the basic properties of a simple loan. Appendix C presents an overview of consumer-choice theory and how it implies the existence of a price-response function. This theory underlies the mathematics of price sensitivity in Chapter 4 and underlies the definition of “consumer rationality” used in Chapter 8.

Price optimization for lending is quite a broad topic, and as a result, this book draws from several different fields, including statistical inference and machine learning, price theory, economics, optimization, risk analysis, and management accounting. Each of these fields is the subject of a vast and varied literature of its own; I have presented only the material that is relevant to price optimization. The notes provide references to other works for readers who would like to dig deeper into a particular topic. This book assumes familiarity with mathematics at the level typically required for an MBA, including basic calculus and some probability theory. For ease of reading, I have kept the number of notes to a minimum and have used in-text references only for direct quotations. Additional references, clarifications, and elaborations can be found in the endnotes to each chapter.

For clarity, I call anyone who is offering a loan a lender and anyone who is considering taking a loan a customer. This seems less clumsy than the more accurate term prospective borrower. If a customer takes a loan, she becomes a borrower. I use the term consumer in a broader sense to refer to individuals as economic decision makers with no specific reference to loans. For clarity, I refer to lenders using male pronouns and customers and borrowers using female pronouns.

This book has an accompanying data set—the “e-Car Data Set”—which can be accessed at http://www.sup.org/pricingcreditproducts or https://info.nomissolutions.com/pricing_credit_products as an Excel file. The data set includes the results of 50,000 loan offers extended by an online lender over a 2-year period to a variety of types of customer. It should enable a reader to replicate the price-sensitivity results in Chapter 5 and to explore alternative approaches to estimating price sensitivity.

Much of this book was written while I was a professor at the Columbia Business School, and it benefited from discussions with many of my colleagues at Columbia, including Guillermo Gallego, Costis Maglaras, Stephan Meier, Serdar Simsek, and Garrett van Ryzin, among others. Much of my thinking on price optimization for lending was developed through my work at Nomis Solutions and my collaboration with many colleagues there, including Prashant Balepur, Hollis Fishelson-Holstein, Matt Kuckuk, Shyue-Ming Loh, and Robin Raffard. Extensive comments on individual chapters were provided by Brenda Barnes, Greg Campbell, Frank Rohde, Mohammad Moghadasi, Eric Wells, and Kai Yin. Additional support and valuable discussion, especially regarding consumers’ liquidity preferences, were provided by other colleagues, including Peter Bagshaw, Virginia McVeigh, Michael Eldredge, Brian Keyser, Megan Lazar, Özalp Özer, Frank Quilty, and Lacy Wagner.

I am grateful to the Stanford Business School for providing me a position as visiting scholar during which I was able to complete much of the book. Thanks also are due to Stanford University Press and to my editor, Margo Beth Fleming. I am especially grateful to Simon Caufield, who was my partner in crime in founding Nomis Solutions with the idea of bringing price-optimization techniques to the financial services industry. And, of course, Doria’s support is critical to anything I do.

1. For example, the New York Times reported on November 11, 2008, “The credit markets seized up as confidence in the nation’s financial system ebbed” (Bajaj and Healy 2008).

2. For the history of price optimization (known as revenue management) and its application in the airline industry, see Barnes (2012) and Phillips (2005).

3. The price track in Figure INT.1 is from the website Camelcamelcamel.com, which provides price tracking for any item sold on Amazon. For a discussion of the pricing algorithms used by sellers on Amazon, see Chen, Mislove, and Wilson (2016).

4. The Canadian unsecured personal lending benefits can be found on the Nomis Solutions website at https://view.highspot.com/viewer/59382bd7b91988384358ffb4.